Page 53 - Bank-Muamalat-Annual-Report-2021

P. 53

ANNUAL REPORT 2021 51

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

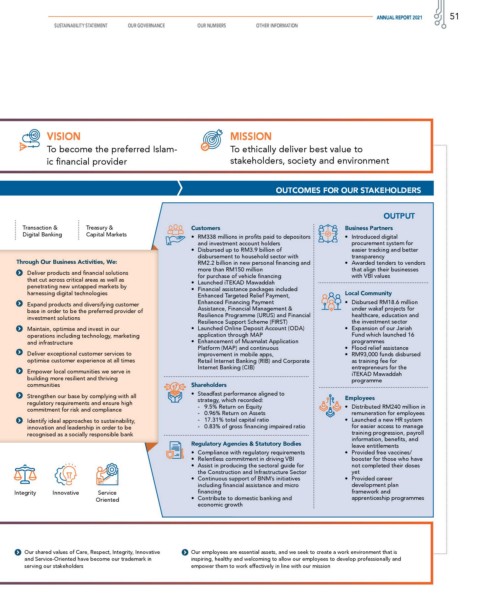

VISION MISSION

To become the preferred Islam- To ethically deliver best value to

ic financial provider stakeholders, society and environment

OUTCOMES FOR OUR STAKEHOLDERS

OUTPUT

Transaction & Treasury & Customers Business Partners

Digital Banking Capital Markets • RM338 millions in profits paid to depositors • Introduced digital

and investment account holders procurement system for

• Disbursed up to RM3.9 billion of easier tracking and better

disbursement to household sector with transparency

Through Our Business Activities, We: RM2.2 billion in new personal financing and • Awarded tenders to vendors

more than RM150 million that align their businesses

Deliver products and financial solutions for purchase of vehicle financing with VBI values

that cut across critical areas as well as • Launched iTEKAD Mawaddah

penetrating new untapped markets by • Financial assistance packages included

harnessing digital technologies Local Community

Enhanced Targeted Relief Payment,

Expand products and diversifying customer Enhanced Financing Payment • Disbursed RM18.6 million

base in order to be the preferred provider of Assistance, Financial Management & under wakaf projects for

investment solutions Resilience Programme (URUS) and Financial healthcare, education and

Resilience Support Scheme (FIRST) the investment sector

Maintain, optimise and invest in our • Launched Online Deposit Account (ODA) • Expansion of our Jariah

operations including technology, marketing application through MAP Fund which launched 16

and infrastructure • Enhancement of Muamalat Application programmes

Platform (MAP) and continuous • Flood relief assistance

Deliver exceptional customer services to improvement in mobile apps, • RM93,000 funds disbursed

optimise customer experience at all times Retail Internet Banking (RIB) and Corporate as training fee for

Internet Banking (CIB) entrepreneurs for the

Empower local communities we serve in

iTEKAD Mawaddah

building more resilient and thriving programme

communities Shareholders

• Steadfast performance aligned to

Strengthen our base by complying with all

strategy, which recorded: Employees

regulatory requirements and ensure high

commitment for risk and compliance - 9.5% Return on Equity • Distributed RM240 million in

- 0.96% Return on Assets remuneration for employees

Identify ideal approaches to sustainability, - 17.31% total capital ratio • Launched a new HR system

innovation and leadership in order to be - 0.83% of gross financing impaired ratio for easier access to manage

recognised as a socially responsible bank training progression, payroll

information, benefits, and

Regulatory Agencies & Statutory Bodies leave entitlements

• Compliance with regulatory requirements • Provided free vaccines/

• Relentless commitment in driving VBI booster for those who have

• Assist in producing the sectoral guide for not completed their doses

the Construction and Infrastructure Sector yet

• Continuous support of BNM’s initiatives • Provided career

including financial assistance and micro development plan

Integrity Innovative Service financing framework and

Oriented • Contribute to domestic banking and apprenticeship programmes

economic growth

Our shared values of Care, Respect, Integrity, Innovative Our employees are essential assets, and we seek to create a work environment that is

and Service-Oriented have become our trademark in inspiring, healthy and welcoming to allow our employees to develop professionally and

serving our stakeholders empower them to work effectively in line with our mission