Page 50 - Bank-Muamalat-Annual-Report-2021

P. 50

48 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

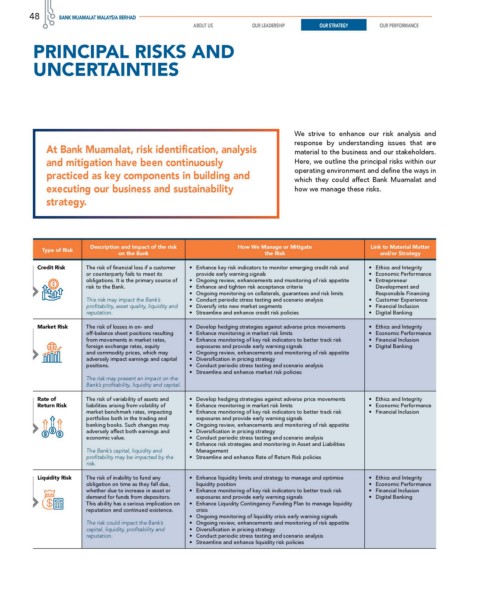

PRINCIPAL RISKS AND

UNCERTAINTIES

We strive to enhance our risk analysis and

response by understanding issues that are

At Bank Muamalat, risk identification, analysis material to the business and our stakeholders.

and mitigation have been continuously Here, we outline the principal risks within our

operating environment and define the ways in

practiced as key components in building and

which they could affect Bank Muamalat and

executing our business and sustainability how we manage these risks.

strategy.

Description and Impact of the risk How We Manage or Mitigate Link to Material Matter

Type of Risk

on the Bank the Risk and/or Strategy

Credit Risk The risk of financial loss if a customer • Enhance key risk indicators to monitor emerging credit risk and • Ethics and Integrity

or counterparty fails to meet its provide early warning signals • Economic Performance

obligations. It is the primary source of • Ongoing review, enhancements and monitoring of risk appetite • Entrepreneur

risk to the Bank. • Enhance and tighten risk acceptance criteria Development and

• Ongoing monitoring on collaterals, guarantees and risk limits Responsible Financing

This risk may impact the Bank’s • Conduct periodic stress testing and scenario analysis • Customer Experience

profitability, asset quality, liquidity and • Diversify into new market segments • Financial Inclusion

reputation. • Streamline and enhance credit risk policies • Digital Banking

Market Risk The risk of losses in on- and • Develop hedging strategies against adverse price movements • Ethics and Integrity

off-balance sheet positions resulting • Enhance monitoring in market risk limits • Economic Performance

from movements in market rates, • Enhance monitoring of key risk indicators to better track risk • Financial Inclusion

foreign exchange rates, equity exposures and provide early warning signals • Digital Banking

and commodity prices, which may • Ongoing review, enhancements and monitoring of risk appetite

adversely impact earnings and capital • Diversification in pricing strategy

positions. • Conduct periodic stress testing and scenario analysis

• Streamline and enhance market risk policies

The risk may present an impact on the

Bank’s profitability, liquidity and capital.

Rate of The risk of variability of assets and • Develop hedging strategies against adverse price movements • Ethics and Integrity

Return Risk liabilities arising from volatility of • Enhance monitoring in market risk limits • Economic Performance

market benchmark rates, impacting • Enhance monitoring of key risk indicators to better track risk • Financial Inclusion

portfolios both in the trading and exposures and provide early warning signals

banking books. Such changes may • Ongoing review, enhancements and monitoring of risk appetite

adversely affect both earnings and • Diversification in pricing strategy

economic value. • Conduct periodic stress testing and scenario analysis

• Enhance risk strategies and monitoring in Asset and Liabilities

The Bank’s capital, liquidity and Management

profitability may be impacted by the • Streamline and enhance Rate of Return Risk policies

risk.

Liquidity Risk The risk of inability to fund any • Enhance liquidity limits and strategy to manage and optimise • Ethics and Integrity

obligation on time as they fall due, liquidity position • Economic Performance

whether due to increase in asset or • Enhance monitoring of key risk indicators to better track risk • Financial Inclusion

demand for funds from depositors. exposures and provide early warning signals • Digital Banking

This ability has a serious implication on • Enhance Liquidity Contingency Funding Plan to manage liquidity

reputation and continued existence. crisis

• Ongoing monitoring of liquidity crisis early warning signals

The risk could impact the Bank’s • Ongoing review, enhancements and monitoring of risk appetite

capital, liquidity, profitability and • Diversification in pricing strategy

reputation. • Conduct periodic stress testing and scenario analysis

• Streamline and enhance liquidity risk policies