Page 51 - Bank-Muamalat-Annual-Report-2021

P. 51

ANNUAL REPORT 2021 49

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

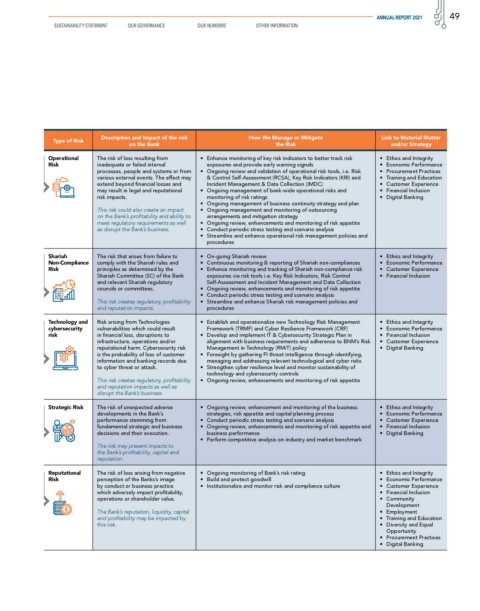

Description and Impact of the risk How We Manage or Mitigate Link to Material Matter

Type of Risk

on the Bank the Risk and/or Strategy

Operational The risk of loss resulting from • Enhance monitoring of key risk indicators to better track risk • Ethics and Integrity

Risk inadequate or failed internal exposures and provide early warning signals • Economic Performance

processes, people and systems or from • Ongoing review and validation of operational risk tools, i.e. Risk • Procurement Practices

various external events. The effect may & Control Self-Assessment (RCSA), Key Risk Indicators (KRI) and • Training and Education

extend beyond financial losses and Incident Management & Data Collection (IMDC) • Customer Experience

may result in legal and reputational • Ongoing management of bank-wide operational risks and • Financial Inclusion

risk impacts. monitoring of risk ratings • Digital Banking

• Ongoing management of business continuity strategy and plan

This risk could also create an impact • Ongoing management and monitoring of outsourcing

on the Bank’s profitability and ability to arrangements and mitigation strategy

meet regulatory requirements as well • Ongoing review, enhancements and monitoring of risk appetite

as disrupt the Bank’s business. • Conduct periodic stress testing and scenario analysis

• Streamline and enhance operational risk management policies and

procedures

Shariah The risk that arises from failure to • On-going Shariah review • Ethics and Integrity

Non-Compliance comply with the Shariah rules and • Continuous monitoring & reporting of Shariah non-compliances • Economic Performance

Risk principles as determined by the • Enhance monitoring and tracking of Shariah non-compliance risk • Customer Experience

Shariah Committee (SC) of the Bank exposures via risk tools i.e. Key Risk Indicators, Risk Control • Financial Inclusion

and relevant Shariah regulatory Self-Assessment and Incident Management and Data Collection

councils or committees. • Ongoing review, enhancements and monitoring of risk appetite

• Conduct periodic stress testing and scenario analysis

This risk creates regulatory, profitability • Streamline and enhance Shariah risk management policies and

and reputation impacts. procedures

Technology and Risk arising from Technologies • Establish and operationalize new Technology Risk Management • Ethics and Integrity

cybersecurity vulnerabilities which could result Framework (TRMF) and Cyber Resilience Framework (CRF) • Economic Performance

risk in financial loss, disruptions to • Develop and implement IT & Cybersecurity Strategic Plan in • Financial Inclusion

infrastructure, operations and/or alignment with business requirements and adherence to BNM’s Risk • Customer Experience

reputational harm. Cybersecurity risk Management in Technology (RMiT) policy • Digital Banking

is the probability of loss of customer • Foresight by gathering FI threat intelligence through identifying,

information and banking records due managing and addressing relevant technological and cyber risks

to cyber threat or attack. • Strengthen cyber resilience level and monitor sustainability of

technology and cybersecurity controls

This risk creates regulatory, profitability • Ongoing review, enhancements and monitoring of risk appetite

and reputation impacts as well as

disrupt the Bank’s business.

Strategic Risk The risk of unexpected adverse • Ongoing review, enhancement and monitoring of the business • Ethics and Integrity

developments in the Bank’s strategies, risk appetite and capital planning process • Economic Performance

performance stemming from • Conduct periodic stress testing and scenario analysis • Customer Experience

fundamental strategic and business • Ongoing review, enhancements and monitoring of risk appetite and • Financial Inclusion

decisions and their execution. business performance • Digital Banking

• Perform competitive analysis on industry and market benchmark

The risk may present impacts to

the Bank’s profitability, capital and

reputation.

Reputational The risk of loss arising from negative • Ongoing monitoring of Bank’s risk rating • Ethics and Integrity

Risk perception of the Banks’s image • Build and protect goodwill • Economic Performance

by conduct or business practice • Institutionalize and monitor risk and compliance culture • Customer Experience

which adversely impact profitability, • Financial Inclusion

operations or shareholder value. • Community

Development

The Bank’s reputation, liquidity, capital • Employment

and profitability may be impacted by • Training and Education

this risk. • Diversity and Equal

Opportunity

• Procurement Practices

• Digital Banking