Page 56 - Bank-Muamalat-Annual-Report-2021

P. 56

54 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

OUR STRATEGIC

DIRECTION

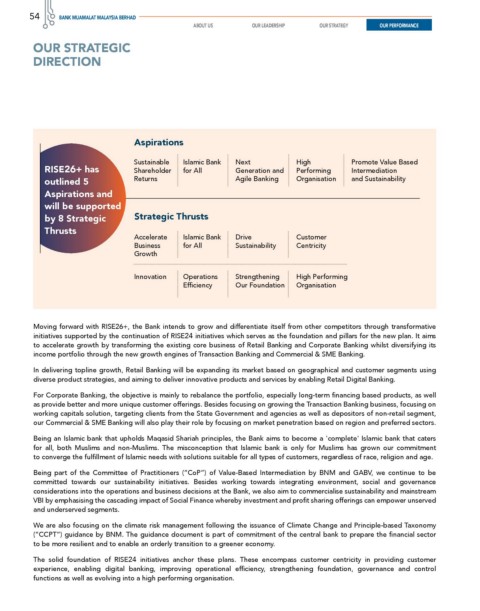

Aspirations

Sustainable Islamic Bank Next High Promote Value Based

RISE26+ has Shareholder for All Generation and Performing Intermediation

outlined 5 Returns Agile Banking Organisation and Sustainability

Aspirations and

will be supported

by 8 Strategic Strategic Thrusts

Thrusts

Accelerate Islamic Bank Drive Customer

Business for All Sustainability Centricity

Growth

Innovation Operations Strengthening High Performing

Efficiency Our Foundation Organisation

Moving forward with RISE26+, the Bank intends to grow and differentiate itself from other competitors through transformative

initiatives supported by the continuation of RISE24 initiatives which serves as the foundation and pillars for the new plan. It aims

to accelerate growth by transforming the existing core business of Retail Banking and Corporate Banking whilst diversifying its

income portfolio through the new growth engines of Transaction Banking and Commercial & SME Banking.

In delivering topline growth, Retail Banking will be expanding its market based on geographical and customer segments using

diverse product strategies, and aiming to deliver innovative products and services by enabling Retail Digital Banking.

For Corporate Banking, the objective is mainly to rebalance the portfolio, especially long-term financing based products, as well

as provide better and more unique customer offerings. Besides focusing on growing the Transaction Banking business, focusing on

working capitals solution, targeting clients from the State Government and agencies as well as depositors of non-retail segment,

our Commercial & SME Banking will also play their role by focusing on market penetration based on region and preferred sectors.

Being an Islamic bank that upholds Maqasid Shariah principles, the Bank aims to become a 'complete' Islamic bank that caters

for all, both Muslims and non-Muslims. The misconception that Islamic bank is only for Muslims has grown our commitment

to converge the fulfillment of Islamic needs with solutions suitable for all types of customers, regardless of race, religion and age.

Being part of the Committee of Practitioners (“CoP”) of Value-Based Intermediation by BNM and GABV, we continue to be

committed towards our sustainability initiatives. Besides working towards integrating environment, social and governance

considerations into the operations and business decisions at the Bank, we also aim to commercialise sustainability and mainstream

VBI by emphasising the cascading impact of Social Finance whereby investment and profit sharing offerings can empower unserved

and underserved segments.

We are also focusing on the climate risk management following the issuance of Climate Change and Principle-based Taxonomy

(“CCPT”) guidance by BNM. The guidance document is part of commitment of the central bank to prepare the financial sector

to be more resilient and to enable an orderly transition to a greener economy.

The solid foundation of RISE24 initiatives anchor these plans. These encompass customer centricity in providing customer

experience, enabling digital banking, improving operational efficiency, strengthening foundation, governance and control

functions as well as evolving into a high performing organisation.