Page 61 - Bank-Muamalat-Annual-Report-2021

P. 61

ANNUAL REPORT 2021 59

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

4% to better-rated customers (i.e. salaries over RM5,000, T20/

M40, and high-income professionals). The Bank will also work

to increase its penetration rate in high-growth areas such

Vehicle Financing’s representation of

as new passenger vehicles, light commercial vehicles,

Retail Banking Division’s Total Financing

Vehicle Assets. and big-bike motorcycles. Launching of new and innovative

Financing products such as step-up financing models will also be part of

the product line-up in 2022. On the VBI front, penetration into

electrical and hybrid vehicles will be a key initiative in 2022.

Performance Review

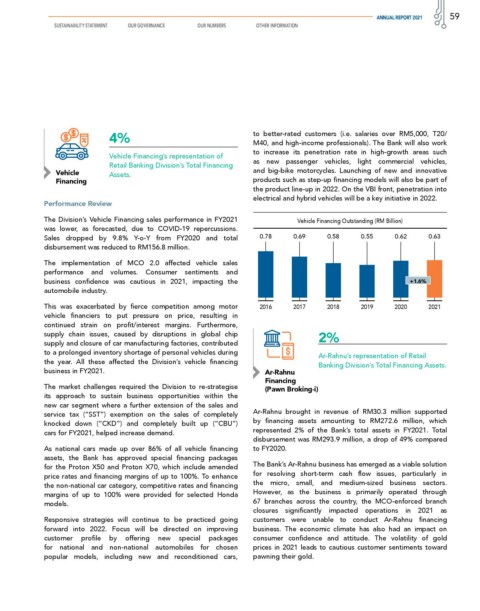

The Division’s Vehicle Financing sales performance in FY2021 Vehicle Financing Outstanding (RM Billion)

was lower, as forecasted, due to COVID-19 repercussions.

Sales dropped by 9.8% Y-o-Y from FY2020 and total 0.78 0.69 0.58 0.55 0.62 0.63

disbursement was reduced to RM156.8 million.

The implementation of MCO 2.0 affected vehicle sales

performance and volumes. Consumer sentiments and

business confidence was cautious in 2021, impacting the +1.6%

automobile industry.

This was exacerbated by fierce competition among motor 2016 2017 2018 2019 2020 2021

vehicle financiers to put pressure on price, resulting in

continued strain on profit/interest margins. Furthermore,

supply chain issues, caused by disruptions in global chip 2%

supply and closure of car manufacturing factories, contributed

to a prolonged inventory shortage of personal vehicles during

Ar-Rahnu’s representation of Retail

the year. All these affected the Division’s vehicle financing

Banking Division’s Total Financing Assets.

business in FY2021. Ar-Rahnu

Financing

The market challenges required the Division to re-strategise

(Pawn Broking-i)

its approach to sustain business opportunities within the

new car segment where a further extension of the sales and

Ar-Rahnu brought in revenue of RM30.3 million supported

service tax (“SST”) exemption on the sales of completely

by financing assets amounting to RM272.6 million, which

knocked down (“CKD”) and completely built up (“CBU”)

represented 2% of the Bank’s total assets in FY2021. Total

cars for FY2021, helped increase demand.

disbursement was RM293.9 million, a drop of 49% compared

As national cars made up over 86% of all vehicle financing to FY2020.

assets, the Bank has approved special financing packages

for the Proton X50 and Proton X70, which include amended The Bank’s Ar-Rahnu business has emerged as a viable solution

price rates and financing margins of up to 100%. To enhance for resolving short-term cash flow issues, particularly in

the non-national car category, competitive rates and financing the micro, small, and medium-sized business sectors.

margins of up to 100% were provided for selected Honda However, as the business is primarily operated through

models. 67 branches across the country, the MCO-enforced branch

closures significantly impacted operations in 2021 as

Responsive strategies will continue to be practiced going customers were unable to conduct Ar-Rahnu financing

forward into 2022. Focus will be directed on improving business. The economic climate has also had an impact on

customer profile by offering new special packages consumer confidence and attitude. The volatility of gold

for national and non-national automobiles for chosen prices in 2021 leads to cautious customer sentiments toward

popular models, including new and reconditioned cars, pawning their gold.