Page 66 - Bank-Muamalat-Annual-Report-2021

P. 66

64 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

COMMERCIAL

BANKING

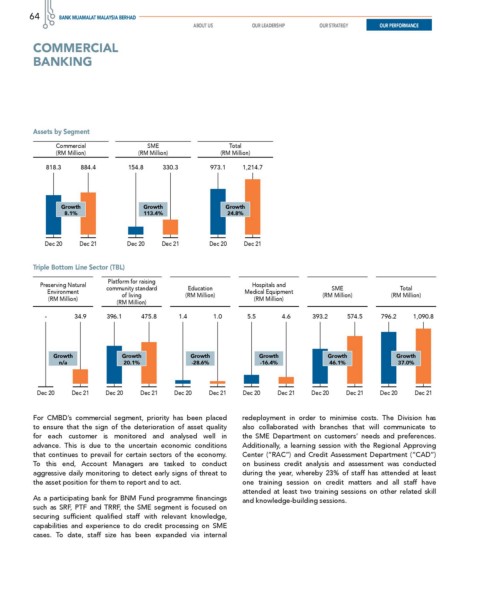

Assets by Segment

Commercial SME Total

(RM Million) (RM Million) (RM Million)

818.3 884.4 154.8 330.3 973.1 1,214.7

Growth Growth Growth

8.1% 113.4% 24.8%

Dec 20 Dec 21 Dec 20 Dec 21 Dec 20 Dec 21

Triple Bottom Line Sector (TBL)

Platform for raising

Preserving Natural community standard Education Hospitals and SME Total

Environment of living (RM Million) Medical Equipment (RM Million) (RM Million)

(RM Million) (RM Million)

(RM Million)

- 34.9 396.1 475.8 1.4 1.0 5.5 4.6 393.2 574.5 796.2 1,090.8

Growth Growth Growth Growth Growth Growth

n/a 20.1% -28.6% -16.4% 46.1% 37.0%

Dec 20 Dec 21 Dec 20 Dec 21 Dec 20 Dec 21 Dec 20 Dec 21 Dec 20 Dec 21 Dec 20 Dec 21

For CMBD’s commercial segment, priority has been placed redeployment in order to minimise costs. The Division has

to ensure that the sign of the deterioration of asset quality also collaborated with branches that will communicate to

for each customer is monitored and analysed well in the SME Department on customers’ needs and preferences.

advance. This is due to the uncertain economic conditions Additionally, a learning session with the Regional Approving

that continues to prevail for certain sectors of the economy. Center (“RAC”) and Credit Assessment Department (“CAD”)

To this end, Account Managers are tasked to conduct on business credit analysis and assessment was conducted

aggressive daily monitoring to detect early signs of threat to during the year, whereby 23% of staff has attended at least

the asset position for them to report and to act. one training session on credit matters and all staff have

attended at least two training sessions on other related skill

As a participating bank for BNM Fund programme financings

and knowledge-building sessions.

such as SRF, PTF and TRRF, the SME segment is focused on

securing sufficient qualified staff with relevant knowledge,

capabilities and experience to do credit processing on SME

cases. To date, staff size has been expanded via internal