Page 52 - Bank-Muamalat-Annual-Report-2021

P. 52

50 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

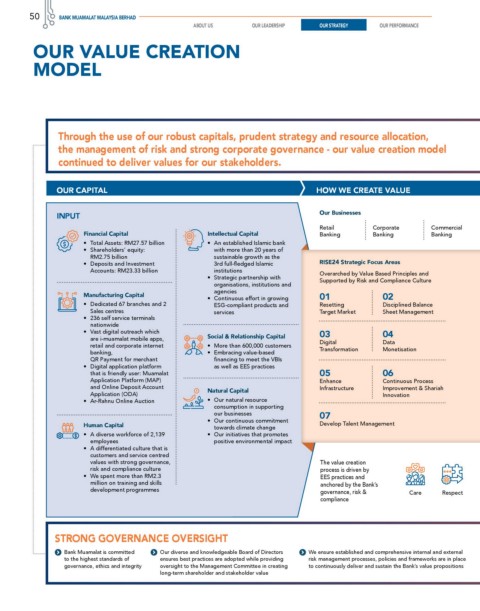

OUR VALUE CREATION

MODEL

Through the use of our robust capitals, prudent strategy and resource allocation,

the management of risk and strong corporate governance - our value creation model

continued to deliver values for our stakeholders.

OUR CAPITAL HOW WE CREATE VALUE

Our Businesses

INPUT

Retail Corporate Commercial

Financial Capital Intellectual Capital Banking Banking Banking

• Total Assets: RM27.57 billion • An established Islamic bank

• Shareholders’ equity: with more than 20 years of

RM2.75 billion sustainable growth as the

• Deposits and Investment 3rd full-fledged Islamic RISE24 Strategic Focus Areas

Accounts: RM23.33 billion institutions Overarched by Value Based Principles and

• Strategic partnership with Supported by Risk and Compliance Culture

organisations, institutions and

agencies

Manufacturing Capital 01 02

• Continuous effort in growing

• Dedicated 67 branches and 2 ESG-compliant products and Resetting Disciplined Balance

Sales centres services Target Market Sheet Management

• 236 self service terminals

nationwide

• Vast digital outreach which 03 04

are i-muamalat mobile apps, Social & Relationship Capital Digital Data

retail and corporate internet • More than 600,000 customers Transformation Monetisation

banking, • Embracing value-based

QR Payment for merchant financing to meet the VBIs

• Digital application platform as well as EES practices

that is friendly user: Muamalat 05 06

Application Platform (MAP) Enhance Continuous Process

and Online Deposit Account Natural Capital Infrastructure Improvement & Shariah

Application (ODA) Innovation

• Ar-Rahnu Online Auction • Our natural resource

consumption in supporting

our businesses 07

• Our continuous commitment

Human Capital towards climate change Develop Talent Management

• A diverse workforce of 2,139 • Our initiatives that promotes

employees positive environmental impact

• A differentiated culture that is

customers and service centred

values with strong governance, The value creation

risk and compliance culture process is driven by

• We spent more than RM2.3 EES practices and

million on training and skills anchored by the Bank’s

development programmes governance, risk & Care Respect

compliance

STRONG GOVERNANCE OVERSIGHT

Bank Muamalat is committed Our diverse and knowledgeable Board of Directors We ensure established and comprehensive internal and external

to the highest standards of ensures best practices are adopted while providing risk management processes, policies and frameworks are in place

governance, ethics and integrity oversight to the Management Committee in creating to continuously deliver and sustain the Bank’s value propositions

long-term shareholder and stakeholder value