Page 45 - Bank-Muamalat-Annual-Report-2021

P. 45

ANNUAL REPORT 2021 43

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

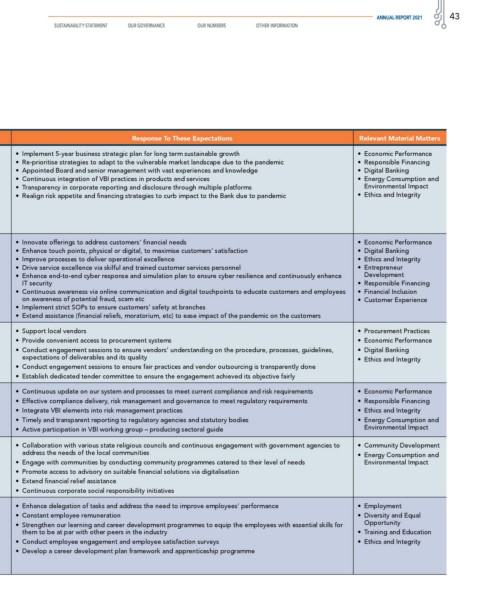

Stakeholder Group Engagement Platform Stakeholders Expectations Response To These Expectations Relevant Material Matters

Shareholders & • Annual reports • Sustainable and long term business strategy that resulted to sustainable financial • Implement 5-year business strategic plan for long term sustainable growth • Economic Performance

Investors • Sustainability statements returns with prudent cost management • Re-prioritise strategies to adapt to the vulnerable market landscape due to the pandemic • Responsible Financing

• Quarterly financial announcements • Proactive management of asset quality and credit risks from exposure to sector • Appointed Board and senior management with vast experiences and knowledge • Digital Banking

• Online communications (e-mail, affected by the pandemic • Continuous integration of VBI practices in products and services • Energy Consumption and

corporate website, social media) • Sound balance sheet management • Transparency in corporate reporting and disclosure through multiple platforms Environmental Impact

• Meetings/discussions (upon • Integration of VBI elements in business operations • Realign risk appetite and financing strategies to curb impact to the Bank due to pandemic • Ethics and Integrity

request) • Ethical and responsible business conduct

• Strong and experienced management

• Transparent reporting and disclosure

• Initiatives to mitigate effects of the pandemic

Customers • Branch representatives • Innovative financial solutions in products and services offered • Innovate offerings to address customers’ financial needs • Economic Performance

• Digital touchpoints: internet • Convenient, continuous and safe access to banking services during the pandemic • Enhance touch points, physical or digital, to maximise customers’ satisfaction • Digital Banking

banking, digital apps • Value-for-banking products and services that is both competitive and transparent • Improve processes to deliver operational excellence • Ethics and Integrity

• Online communications (e-mails, • Secured and safe environment to conduct banking activities especially through • Drive service excellence via skilful and trained customer services personnel • Entrepreneur

corporate website, social media digital channels with strict customers data protection • Enhance end-to-end cyber response and simulation plan to ensure cyber resilience and continuously enhance Development

• Customer service centres • Excellent customer service IT security • Responsible Financing

• Call centres • Financial assistance that can ease their financial burden • Continuous awareness via online communication and digital touchpoints to educate customers and employees • Financial Inclusion

• Customer networking events on awareness of potential fraud, scam etc • Customer Experience

• Printed materials • Implement strict SOPs to ensure customers’ safety at branches

• Customers’ survey • Extend assistance (financial reliefs, moratorium, etc) to ease impact of the pandemic on the customers

Business Partners • Online communications (e-mail, • Fair and equal evaluation of vendors and their proposals • Support local vendors • Procurement Practices

corporate website, social media) • Communicate fair conditions that satisfies both suppliers and the Bank’s needs • Provide convenient access to procurement systems • Economic Performance

• Formal & informal engagements

• Communicate new policies, guidelines or strategy to ensure optimal performance • Conduct engagement sessions to ensure vendors’ understanding on the procedure, processes, guidelines, • Digital Banking

• e-Procurement system expectations of deliverables and its quality

• Transparent reporting and disclosure to ensure smooth collaboration with • Ethics and Integrity

potential partners • Conduct engagement sessions to ensure fair practices and vendor outsourcing is transparently done

• Establish dedicated tender committee to ensure the engagement achieved its objective fairly

Regulatory Agencies • Regular updates and reporting to • Compliance with all legal and regulatory requirements • Continuous update on our system and processes to meet current compliance and risk requirements • Economic Performance

& Statutory Bodies regulators • Good corporate governance • Effective compliance delivery, risk management and governance to meet regulatory requirements • Responsible Financing

• Actively participation in regulatory • Transparent reporting and disclosures • Integrate VBI elements into risk management practices • Ethics and Integrity

forums, briefings, meetings,

conferences and consultation • Participation and contribution to industry and regulatory working group • Timely and transparent reporting to regulatory agencies and statutory bodies • Energy Consumption and

papers • Active participation in VBI working group – producing sectoral guide Environmental Impact

Local Community • Community engagement activities • Financial and VBI literacy awareness • Collaboration with various state religious councils and continuous engagement with government agencies to • Community Development

• Online communications (e-mails, • BMMB efforts in tackling on common social, economic and environmental issues address the needs of the local communities • Energy Consumption and

corporate website, social media) • Providing feasible and convenient access to advisory on suitable financial • Engage with communities by conducting community programmes catered to their level of needs Environmental Impact

• Digital touchpoints (mobile apps, solutions • Promote access to advisory on suitable financial solutions via digitalisation

internet banking, SMS blasts) • BMMB role in building resilient and thriving community • Extend financial relief assistance

• Printed materials • Continuous corporate social responsibility initiatives

Employees • Internal portal and emails • Fair remuneration, recognition and effective performance management • Enhance delegation of tasks and address the need to improve employees’ performance • Employment

• Employee dialogue sessions with • Balanced work-life environment • Constant employee remuneration • Diversity and Equal

CEO • Various opportunities for career development and advancement • Strengthen our learning and career development programmes to equip the employees with essential skills for Opportunity

• Annual engagement survey • An empowering environment that embraces diversity and enables employees to them to be at par with other peers in the industry • Training and Education

• Social and recreational activities deliver quality work output • Conduct employee engagement and employee satisfaction surveys • Ethics and Integrity

• Regular employee engagement • A safe, healthy and conducive workplace supported by flexible work practices • Develop a career development plan framework and apprenticeship programme

events and programmes

• Meetings and roadshows