Page 44 - Bank-Muamalat-Annual-Report-2021

P. 44

42 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

STAKEHOLDER

ENGAGEMENT

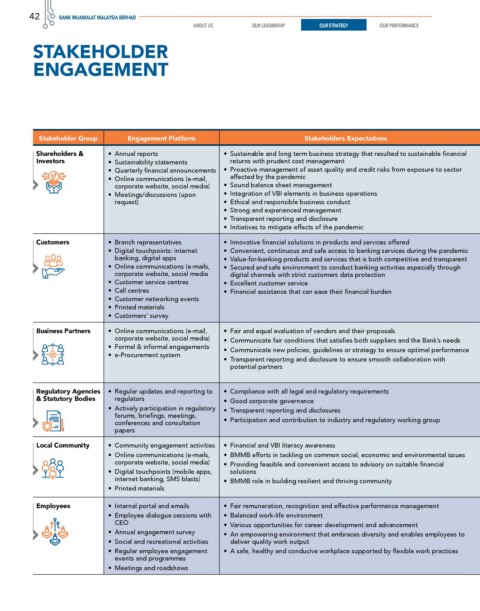

Stakeholder Group Engagement Platform Stakeholders Expectations Response To These Expectations Relevant Material Matters

Shareholders & • Annual reports • Sustainable and long term business strategy that resulted to sustainable financial • Implement 5-year business strategic plan for long term sustainable growth • Economic Performance

Investors • Sustainability statements returns with prudent cost management • Re-prioritise strategies to adapt to the vulnerable market landscape due to the pandemic • Responsible Financing

• Quarterly financial announcements • Proactive management of asset quality and credit risks from exposure to sector • Appointed Board and senior management with vast experiences and knowledge • Digital Banking

• Online communications (e-mail, affected by the pandemic • Continuous integration of VBI practices in products and services • Energy Consumption and

corporate website, social media) • Sound balance sheet management • Transparency in corporate reporting and disclosure through multiple platforms Environmental Impact

• Meetings/discussions (upon • Integration of VBI elements in business operations • Realign risk appetite and financing strategies to curb impact to the Bank due to pandemic • Ethics and Integrity

request) • Ethical and responsible business conduct

• Strong and experienced management

• Transparent reporting and disclosure

• Initiatives to mitigate effects of the pandemic

Customers • Branch representatives • Innovative financial solutions in products and services offered • Innovate offerings to address customers’ financial needs • Economic Performance

• Digital touchpoints: internet • Convenient, continuous and safe access to banking services during the pandemic • Enhance touch points, physical or digital, to maximise customers’ satisfaction • Digital Banking

banking, digital apps • Value-for-banking products and services that is both competitive and transparent • Improve processes to deliver operational excellence • Ethics and Integrity

• Online communications (e-mails, • Secured and safe environment to conduct banking activities especially through • Drive service excellence via skilful and trained customer services personnel • Entrepreneur

corporate website, social media digital channels with strict customers data protection • Enhance end-to-end cyber response and simulation plan to ensure cyber resilience and continuously enhance Development

• Customer service centres • Excellent customer service IT security • Responsible Financing

• Call centres • Financial assistance that can ease their financial burden • Continuous awareness via online communication and digital touchpoints to educate customers and employees • Financial Inclusion

• Customer networking events on awareness of potential fraud, scam etc • Customer Experience

• Printed materials • Implement strict SOPs to ensure customers’ safety at branches

• Customers’ survey • Extend assistance (financial reliefs, moratorium, etc) to ease impact of the pandemic on the customers

Business Partners • Online communications (e-mail, • Fair and equal evaluation of vendors and their proposals • Support local vendors • Procurement Practices

corporate website, social media) • Communicate fair conditions that satisfies both suppliers and the Bank’s needs • Provide convenient access to procurement systems • Economic Performance

• Formal & informal engagements

• Communicate new policies, guidelines or strategy to ensure optimal performance • Conduct engagement sessions to ensure vendors’ understanding on the procedure, processes, guidelines, • Digital Banking

• e-Procurement system expectations of deliverables and its quality

• Transparent reporting and disclosure to ensure smooth collaboration with • Ethics and Integrity

potential partners • Conduct engagement sessions to ensure fair practices and vendor outsourcing is transparently done

• Establish dedicated tender committee to ensure the engagement achieved its objective fairly

Regulatory Agencies • Regular updates and reporting to • Compliance with all legal and regulatory requirements • Continuous update on our system and processes to meet current compliance and risk requirements • Economic Performance

& Statutory Bodies regulators • Good corporate governance • Effective compliance delivery, risk management and governance to meet regulatory requirements • Responsible Financing

• Actively participation in regulatory • Transparent reporting and disclosures • Integrate VBI elements into risk management practices • Ethics and Integrity

forums, briefings, meetings,

conferences and consultation • Participation and contribution to industry and regulatory working group • Timely and transparent reporting to regulatory agencies and statutory bodies • Energy Consumption and

papers • Active participation in VBI working group – producing sectoral guide Environmental Impact

Local Community • Community engagement activities • Financial and VBI literacy awareness • Collaboration with various state religious councils and continuous engagement with government agencies to • Community Development

• Online communications (e-mails, • BMMB efforts in tackling on common social, economic and environmental issues address the needs of the local communities • Energy Consumption and

corporate website, social media) • Providing feasible and convenient access to advisory on suitable financial • Engage with communities by conducting community programmes catered to their level of needs Environmental Impact

• Digital touchpoints (mobile apps, solutions • Promote access to advisory on suitable financial solutions via digitalisation

internet banking, SMS blasts) • BMMB role in building resilient and thriving community • Extend financial relief assistance

• Printed materials • Continuous corporate social responsibility initiatives

Employees • Internal portal and emails • Fair remuneration, recognition and effective performance management • Enhance delegation of tasks and address the need to improve employees’ performance • Employment

• Employee dialogue sessions with • Balanced work-life environment • Constant employee remuneration • Diversity and Equal

CEO • Various opportunities for career development and advancement • Strengthen our learning and career development programmes to equip the employees with essential skills for Opportunity

• Annual engagement survey • An empowering environment that embraces diversity and enables employees to them to be at par with other peers in the industry • Training and Education

• Social and recreational activities deliver quality work output • Conduct employee engagement and employee satisfaction surveys • Ethics and Integrity

• Regular employee engagement • A safe, healthy and conducive workplace supported by flexible work practices • Develop a career development plan framework and apprenticeship programme

events and programmes

• Meetings and roadshows