Page 43 - Bank-Muamalat-Annual-Report-2021

P. 43

ANNUAL REPORT 2021 41

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

Outlook For Islamic Financing

According to recent findings from RAM Ratings, Islamic Being another emerging trend that is influencing the

financing growth will stay healthy at 10% in 2022 (2021: direction of the modern Islamic Finance sphere, Islamic

+8.2%) as a result of improved economic conditions. Fintech has significantly increased in importance despite it

The industry’s gross impaired financing ratio is projected being in its early years of development especially due to the

to reach 2% by end-2022 (end-December 2021: 1.2%). rapid digitalisation rates caused by COVID-19.

However, there’s a chance of flat profitability this year for

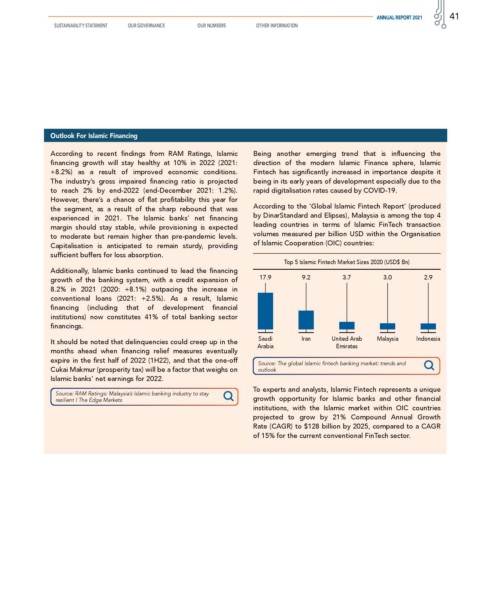

the segment, as a result of the sharp rebound that was According to the ‘Global Islamic Fintech Report’ (produced

experienced in 2021. The Islamic banks’ net financing by DinarStandard and Elipses), Malaysia is among the top 4

margin should stay stable, while provisioning is expected leading countries in terms of Islamic FinTech transaction

to moderate but remain higher than pre-pandemic levels. volumes measured per billion USD within the Organisation

Capitalisation is anticipated to remain sturdy, providing of Islamic Cooperation (OIC) countries:

sufficient buffers for loss absorption.

Top 5 Islamic Fintech Market Sizes 2020 (USD$ Bn)

Additionally, Islamic banks continued to lead the financing

growth of the banking system, with a credit expansion of 17.9 9.2 3.7 3.0 2.9

8.2% in 2021 (2020: +8.1%) outpacing the increase in

conventional loans (2021: +2.5%). As a result, Islamic

financing (including that of development financial

institutions) now constitutes 41% of total banking sector

financings.

It should be noted that delinquencies could creep up in the Saudi Iran United Arab Malaysia Indonesia

Arabia Emirates

months ahead when financing relief measures eventually

expire in the first half of 2022 (1H22), and that the one-off Source: The global Islamic fintech banking market: trends and

Cukai Makmur (prosperity tax) will be a factor that weighs on outlook

Islamic banks’ net earnings for 2022.

To experts and analysts, Islamic Fintech represents a unique

Source: RAM Ratings: Malaysia’s Islamic banking industry to stay

resilient | The Edge Markets growth opportunity for Islamic banks and other financial

institutions, with the Islamic market within OIC countries

projected to grow by 21% Compound Annual Growth

Rate (CAGR) to $128 billion by 2025, compared to a CAGR

of 15% for the current conventional FinTech sector.