Page 52 - Bank-Muamalat_Annual-Report-2023

P. 52

BANK MUAMALAT MALAYSIA BERHAD

OUR STRATEGIC

DIRECTION

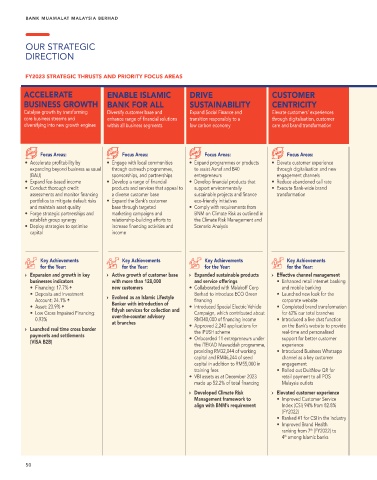

FY2023 STRATEGIC THRUSTS AND PRIORITY FOCUS AREAS

ACCELERATE ENABLE ISLAMIC DRIVE CUSTOMER

BUSINESS GROWTH BANK FOR ALL SUSTAINABILITY CENTRICITY

Catalyse growth by transforming Diversify customer base and Expand Social Finance and Elevate customers’ experiences

core business streams and enhance range of financial solutions transition responsibly to a through digitalisation, customer

diversifying into new growth engines within all business segments low carbon economy care and brand transformation

Focus Areas: Focus Areas: Focus Areas: Focus Areas:

• Accelerate profitability by • Engage with local communities • Expand programmes or products • Elevate customer experience

expanding beyond business as usual through outreach programmes, to assist Asnaf and B40 through digitalisation and new

(BAU) sponsorships, and partnerships entrepreneurs engagement channels

• Expand fee-based income • Develop a range of financial • Develop financial products that • Reduce abandoned call rate

• Conduct thorough credit products and services that appeal to support environmentally • Execute Bank-wide brand

assessments and monitor financing a diverse customer base sustainable projects and finance transformation

portfolios to mitigate default risks • Expand the Bank’s customer eco-friendly initiatives

and maintain asset quality base through targeted • Comply with requirements from

• Forge strategic partnerships and marketing campaigns and BNM on Climate Risk as outlined in

establish group synergy relationship-building efforts to the Climate Risk Management and

• Deploy strategies to optimise increase financing activities and Scenario Analysis

capital income

Key Achievements Key Achievements Key Achievements Key Achievements

for the Year: for the Year: for the Year: for the Year:

→ Expansion and growth in key → Active growth of customer base → Expanded sustainable products → Effective channel management

businesses indicators with more than 128,000 and service offerings • Enhanced retail internet banking

• Financing: 17.7% new customers • Collaborated with Malakoff Corp and mobile banking

• Deposits and Investment Berhad to introduce ECO Green • Launched new look for the

Account: 24.1% → Evolved as an Islamic Lifestyle financing corporate website

• Asset: 23.9% Banker with introduction of • Introduced Special Electric Vehicle • Completed brand transformation

• Low Gross Impaired Financing: fidyah services for collection and Campaign, which contributed about for 62% our total branches

0.93% over-the-counter advisory RM340,000 of financing income • Introduced a live chat function

at branches • Approved 2,240 applications for on the Bank’s website to provide

→ Launched real time cross border the iPUSH scheme real-time and personalised

payments and settlements • Onboarded 11 entrepreneurs under support for better customer

(VISA B2B)

the iTEKAD Mawaddah programme, experience

providing RM32,044 of working • Introduced Business Whatsapp

capital and RM46,244 of seed channel as a key customer

capital in addition to RM55,000 in engagement

training fees • Rolled out DuitNow QR for

• VBI assets as at December 2023 retail payment to all POS

made up 52.2% of total financing Malaysia outlets

→ Developed Climate Risk → Elevated customer experience

Management framework to • Improved Customer Service

align with BNM’s requirement Index (CSI) 94% from 82.8%

(FY2022)

• Ranked #1 for CSI in the industry

• Improved Brand Health

th

ranking from 7 (FY2022) to

th

4 among Islamic banks

50