Page 48 - Bank-Muamalat_Annual-Report-2023

P. 48

BANK MUAMALAT MALAYSIA BERHAD

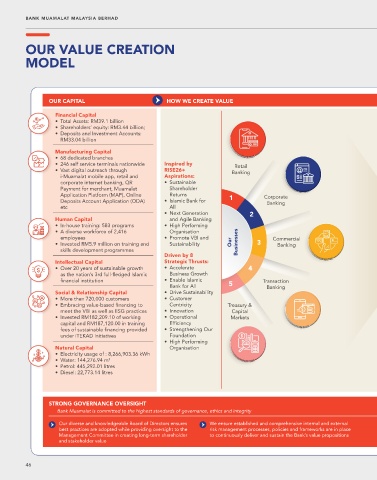

OUR VALUE CREATION

MODEL

OUR CAPITAL HOW WE CREATE VALUE

Financial Capital

• Total Assets: RM39.1 billion

• Shareholders’ equity: RM3.44 billion;

• Deposits and Investment Accounts:

RM33.04 billion

Manufacturing Capital

• 68 dedicated branches

• 246 self service terminals nationwide Inspired by Retail

• Vast digital outreach through RISE26+ Banking

i-Muamalat mobile app, retail and Aspirations:

corporate internet banking, QR • Sustainable

Payment for merchant, Muamalat Shareholder

Application Platform (MAP), Online Returns 1 Corporate

Deposits Account Application (ODA) • Islamic Bank for Banking

etc All

• Next Generation 2

Human Capital and Agile Banking

• In-house training: 583 programs • High Performing

• A diverse workforce of 2,416 Organisation

employees • Promote VBI and Commercial

• Invested RM5.9 million on training and Sustainability Our Businesses 3 Banking

skills development programmes

Driven by 8

Intellectual Capital Strategic Thrusts:

• Over 20 years of sustainable growth • Accelerate 4

as the nation’s 3rd full-fledged Islamic Business Growth

financial institution • Enable Islamic Transaction

Bank for All 5 Banking

Social & Relationship Capital • Drive Sustainability

• More than 720,000 customers • Customer

• Embracing value-based financing to Centricity Treasury &

meet the VBI as well as ESG practices • Innovation Capital

• Invested RM182,209.10 of working • Operational Markets

capital and RM187,120.00 in training Efficiency

fees of sustainable financing provided • Strengthening Our

under iTEKAD initiatives Foundation

• High Performing

Natural Capital Organisation

• Electricity usage of : 8,266,903.36 kWh

• Water: 144,276.94 m 3

• Petrol: 445,292.01 litres

• Diesel: 22,773.14 litres

STRONG GOVERNANCE OVERSIGHT

Bank Muamalat is committed to the highest standards of governance, ethics and integrity

Our diverse and knowledgeable Board of Directors ensures We ensure established and comprehensive internal and external

best practices are adopted while providing oversight to the risk management processes, policies and frameworks are in place

Management Committee in creating long-term shareholder to continuously deliver and sustain the Bank’s value propositions

and stakeholder value

46