Page 49 - Bank-Muamalat_Annual-Report-2023

P. 49

ANNUAL REPORT 2023

OUR STRATEGY

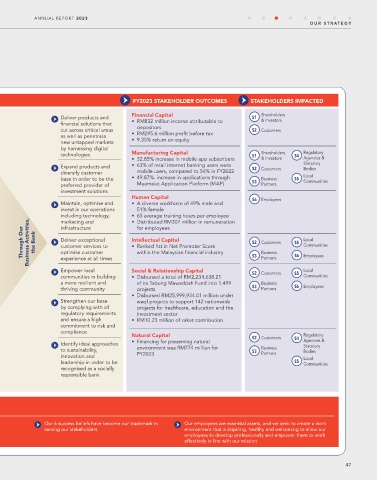

FY2023 STAKEHOLDER OUTCOMES STAKEHOLDERS IMPACTED

Financial Capital Shareholders

Deliver products and S1 & Investors

financial solutions that • RM832 million income attributable to

cut across critical areas depositors S2 Customers

as well as penetrate • RM295.6 million profit before tax

new untapped markets • 9.35% return on equity

by harnessing digital

technologies Manufacturing Capital S1 Shareholders S4 Regulatory

• 32.85% increase in mobile app subscribers & Investors Agencies &

Expand products and • 63% of retail internet banking users were S2 Customers Statutory

Bodies

diversify customer mobile users, compared to 54% in FY2022 Local

base in order to be the • 49.87%. increase in applications through S3 Business S5 Communities

preferred provider of Muamalat Application Platform (MAP) Partners

investment solutions

Human Capital

S6 Employees

Maintain, optimise and • A diverse workforce of 49% male and

invest in our operations • 65 average training hours per employee

51% female

including technology,

marketing and

• Distributed RM307 million in remuneration

Through Our Business Activities, the Bank infrastructure Intellectual Capital S2 Customers S5 Local

for employees

Deliver exceptional

Communities

customer services to

• Ranked 1st in Net Promoter Score

Business

within the Malaysian financial industry

optimise customer

S6

Employees

experience at all times

Empower local Social & Relationship Capital S3 Partners S5 Local

S2

Customers

communities in building • Disbursed a total of RM2,234,638.21 Communities

a more resilient and of its Tabung Mawaddah Fund into 1,499 Business

thriving community projects S3 Partners S6 Employees

• Disbursed RM25,999,934.01 million under

Strengthen our base waqf projects to support 142 nationwide

by complying with all projects for healthcare, education and the

regulatory requirements investment sector

and ensure a high • RM10.23 million of zakat contribution

commitment to risk and

compliance

Natural Capital S2 Customers S4 Regulatory

• Financing for preserving natural Agencies &

Identify ideal approaches Statutory

to sustainability, environment was RM774 million for S3 Business Bodies

innovation and FY2023 Partners Local

leadership in order to be S5 Communities

recognised as a socially

responsible bank

Bank Muamalat is committed to the highest standards of governance, ethics and integrity

Our 6 success beliefs have become our trademark in Our employees are essential assets, and we seek to create a work

serving our stakeholders environment that is inspiring, healthy and welcoming to allow our

employees to develop professionally and empower them to work

effectively in line with our mission

47