Page 304 - Bank-Muamalat-Annual-Report-2021

P. 304

302 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

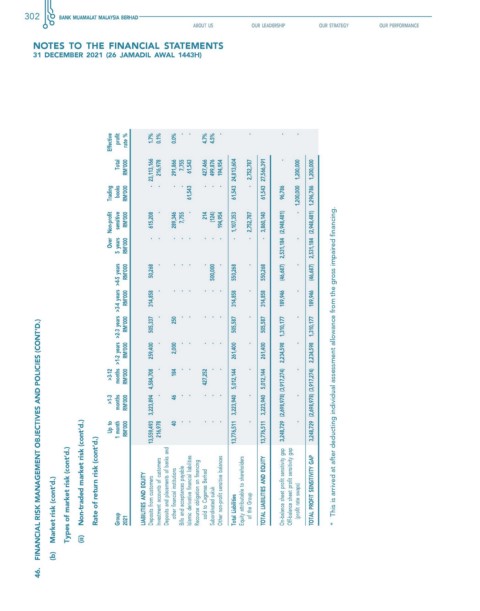

effective profit rate % 1.7% 0.1% 0.0% - - 4.7% 4.5% - - - -

-

Total RM’000 - 23,113,166 216,978 291,866 7,755 61,543 427,466 499,876 194,954 - 2,752,787

Trading books RM’000 - - - 61,543 - - - 61,543 24,813,604 61,543 27,566,391 96,786 - 1,200,000 1,200,000 2,531,184 (2,948,481) 1,296,786 1,200,000

Over Non-profit sensitive 5 years RM’000 RM’000 615,208 - - - 289,346 - 7,755 - - - 214 - (124) - 194,954 - - 1,107,353 - 2,752,787 - 3,860,140 2,531,184 (2,948,481) -

months >1-2 years >2-3 years >3-4 years >4-5 years RM’000 505,337 505,587 505,587

RM’000 50,268 - - - - - 500,000 - 550,268 - 550,268 (46,687) - (46,687)

RM’000 314,858 - - - - - - - 314,858 - 314,858 189,946 - 189,946

- 250 - - - - - - -

fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

RM’000 259,400 - 2,000 - - - - - 261,400 - 261,400 2,234,598 1,310,177 - 2,234,598 1,310,177

>3-12 RM’000 - 184 - - 427,252 - - - - This is arrived at after deducting individual assessment allowance from the gross impaired financing.

>1-3 up to months 1 month RM’000 RM’000 13,559,493 3,223,894 4,584,708 - 216,978 46 40 - - - - - - - - - - 13,776,511 3,223,940 5,012,144 - - 13,776,511 3,223,940 5,012,144 On-balance sheet profit sensitivity gap 3,248,729 (2,698,978) (3,917,274) - - 3,248,729 (2,698,978) (3,917,274)

Market risk (cont’d.) Types of market risk (cont’d.) Non-traded market risk (cont’d.) Rate of return risk (cont’d.) Group 2021 liabilities anD equity Deposits from customers Investment accounts of customers Deposits and placements of banks and other financial institutions Bills and acceptances payable Islamic derivative financial liabilities Recourse obligation on financing sold to Cagamas Berhad Subordinated sukuk Other non-profit sensitive balances

(b) (ii)

46.