Page 300 - Bank-Muamalat-Annual-Report-2021

P. 300

298 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

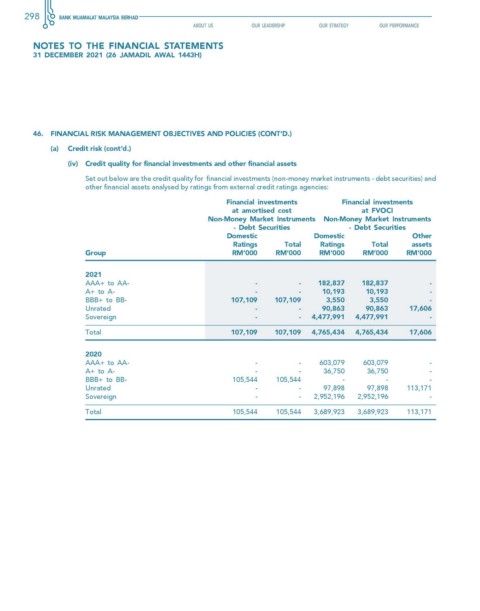

(iv) credit quality for financial investments and other financial assets

Set out below are the credit quality for financial investments (non-money market instruments - debt securities) and

other financial assets analysed by ratings from external credit ratings agencies:

financial investments financial investments

at amortised cost at fvOcI

Non-Money Market Instruments Non-Money Market Instruments

- Debt securities - Debt securities

Domestic Domestic Other

Ratings Total Ratings Total assets

Group RM’000 RM’000 RM’000 RM’000 RM’000

2021

AAA+ to AA- - - 182,837 182,837 -

A+ to A- - - 10,193 10,193 -

BBB+ to BB- 107,109 107,109 3,550 3,550 -

Unrated - - 90,863 90,863 17,606

Sovereign - - 4,477,991 4,477,991 -

Total 107,109 107,109 4,765,434 4,765,434 17,606

2020

AAA+ to AA- - - 603,079 603,079 -

A+ to A- - - 36,750 36,750 -

BBB+ to BB- 105,544 105,544 - - -

Unrated - - 97,898 97,898 113,171

Sovereign - - 2,952,196 2,952,196 -

Total 105,544 105,544 3,689,923 3,689,923 113,171