Page 301 - Bank-Muamalat-Annual-Report-2021

P. 301

ANNUAL REPORT 2021 299

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

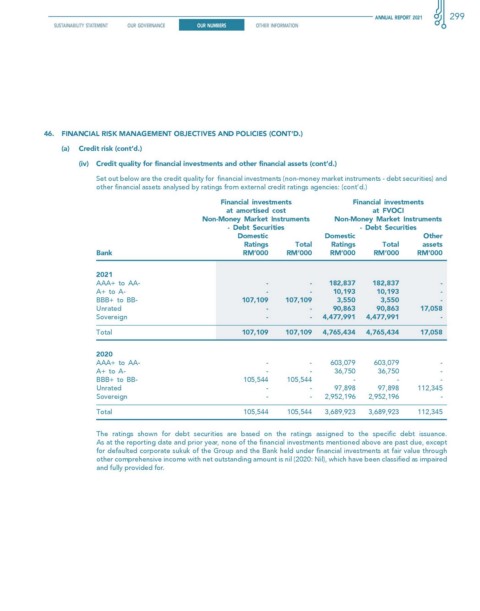

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

(iv) credit quality for financial investments and other financial assets (cont’d.)

Set out below are the credit quality for financial investments (non-money market instruments - debt securities) and

other financial assets analysed by ratings from external credit ratings agencies: (cont’d.)

financial investments financial investments

at amortised cost at fvOcI

Non-Money Market Instruments Non-Money Market Instruments

- Debt securities - Debt securities

Domestic Domestic Other

Ratings Total Ratings Total assets

Bank RM’000 RM’000 RM’000 RM’000 RM’000

2021

AAA+ to AA- - - 182,837 182,837 -

A+ to A- - - 10,193 10,193 -

BBB+ to BB- 107,109 107,109 3,550 3,550 -

Unrated - - 90,863 90,863 17,058

Sovereign - - 4,477,991 4,477,991 -

Total 107,109 107,109 4,765,434 4,765,434 17,058

2020

AAA+ to AA- - - 603,079 603,079 -

A+ to A- - - 36,750 36,750 -

BBB+ to BB- 105,544 105,544 - - -

Unrated - - 97,898 97,898 112,345

Sovereign - - 2,952,196 2,952,196 -

Total 105,544 105,544 3,689,923 3,689,923 112,345

The ratings shown for debt securities are based on the ratings assigned to the specific debt issuance.

As at the reporting date and prior year, none of the financial investments mentioned above are past due, except

for defaulted corporate sukuk of the Group and the Bank held under financial investments at fair value through

other comprehensive income with net outstanding amount is nil (2020: Nil), which have been classified as impaired

and fully provided for.