Page 306 - Bank-Muamalat-Annual-Report-2021

P. 306

304 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

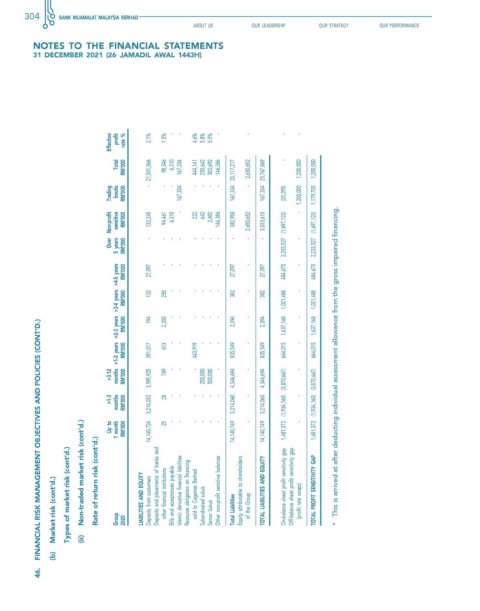

effective profit rate % 2.1% 1.5% - - 4.6% 5.8% 5.5% - - - -

Total RM’000 - 21,501,366 98,346 6,310 167,334 444,141 250,642 502,692 146,386 2,650,652 1,200,000 1,200,000

-

Trading books RM’000 - - 167,334 - - - - 167,334 23,117,217 - 167,334 25,767,869 (20,295) 1,200,000 1,179,705

Over Non-profit sensitive 5 years RM’000 RM’000 132,245 - 94,461 - 6,310 - - - 222 - 642 - 2,692 - 146,386 - 382,958 - 2,650,652 - 3,033,610 - 2,233,527 (1,697,123) - - 2,233,527 (1,697,123)

months >1-2 years >2-3 years >3-4 years >4-5 years RM’000 2,200 2,394 2,394 1,637,168 1,637,168

RM’000 27,097 - - - - - - - 27,097 - 27,097 484,675 - 484,675

RM’000 132 250 - - - - - - 382 - 382 1,021,488 - 1,021,488

194 - - - - - - - -

fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

RM’000 391,017 613 - - 443,919 - - - 835,549 - 835,549 664,015 - 664,015

>3-12 RM’000 3,595,925 769 - - - 250,000 500,000 - 4,346,694 - 4,346,694 - This is arrived at after deducting individual assessment allowance from the gross impaired financing.

>1-3 up to months 1 month RM’000 RM’000 3,214,032 14,140,724 28 25 - - - - - - - - - - - - 3,214,060 14,140,749 - - 3,214,060 14,140,749 1,481,372 (1,934,160) (3,870,667) - - 1,481,372 (1,934,160) (3,870,667)

Market risk (cont’d.) Types of market risk (cont’d.) Non-traded market risk (cont’d.) Rate of return risk (cont’d.) Group 2020 liabilities anD equity Deposits from customers Deposits and placements of banks and other financial institutions Bills and acceptances payable Islamic derivative financial liabilities Recourse obligation on financing sold to Cagamas Berhad Subordinated sukuk Senior Sukuk Other non-profit sensitive balances Total Liabilities

(b) (ii)

46.