Page 298 - Bank-Muamalat-Annual-Report-2021

P. 298

296 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

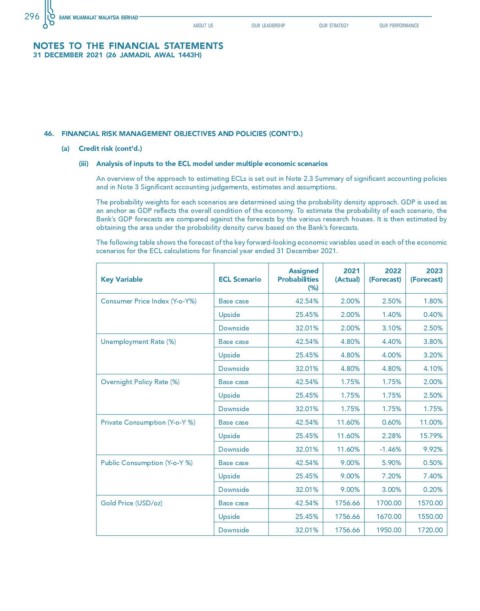

(iii) Analysis of inputs to the ecL model under multiple economic scenarios

An overview of the approach to estimating ECLs is set out in Note 2.3 Summary of significant accounting policies

and in Note 3 Significant accounting judgements, estimates and assumptions.

The probability weights for each scenarios are determined using the probability density approach. GDP is used as

an anchor as GDP reflects the overall condition of the economy. To estimate the probability of each scenario, the

Bank’s GDP forecasts are compared against the forecasts by the various research houses. It is then estimated by

obtaining the area under the probability density curve based on the Bank’s forecasts.

The following table shows the forecast of the key forward-looking economic variables used in each of the economic

scenarios for the ECL calculations for financial year ended 31 December 2021.

Assigned 2021 2022 2023

key variable ecL scenario Probabilities (Actual) (forecast) (forecast)

(%)

Consumer Price Index (Y-o-Y%) Base case 42.54% 2.00% 2.50% 1.80%

Upside 25.45% 2.00% 1.40% 0.40%

Downside 32.01% 2.00% 3.10% 2.50%

Unemployment Rate (%) Base case 42.54% 4.80% 4.40% 3.80%

Upside 25.45% 4.80% 4.00% 3.20%

Downside 32.01% 4.80% 4.80% 4.10%

Overnight Policy Rate (%) Base case 42.54% 1.75% 1.75% 2.00%

Upside 25.45% 1.75% 1.75% 2.50%

Downside 32.01% 1.75% 1.75% 1.75%

Private Consumption (Y-o-Y %) Base case 42.54% 11.60% 0.60% 11.00%

Upside 25.45% 11.60% 2.28% 15.79%

Downside 32.01% 11.60% -1.46% 9.92%

Public Consumption (Y-o-Y %) Base case 42.54% 9.00% 5.90% 0.50%

Upside 25.45% 9.00% 7.20% 7.40%

Downside 32.01% 9.00% 3.00% 0.20%

Gold Price (USD/oz) Base case 42.54% 1756.66 1700.00 1570.00

Upside 25.45% 1756.66 1670.00 1550.00

Downside 32.01% 1756.66 1950.00 1720.00