Page 295 - Bank-Muamalat-Annual-Report-2021

P. 295

ANNUAL REPORT 2021 293

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

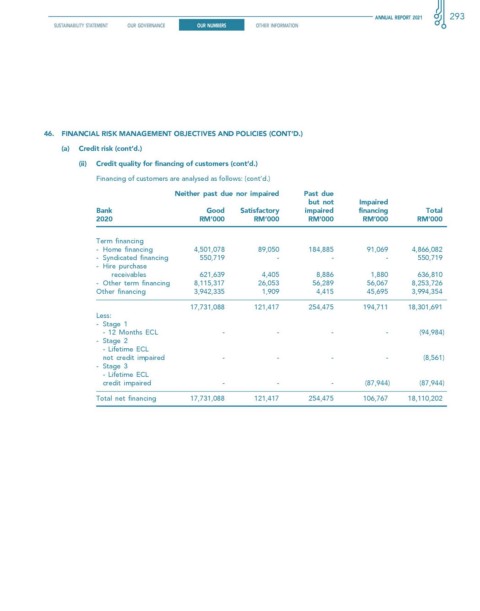

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

(ii) credit quality for financing of customers (cont’d.)

Financing of customers are analysed as follows: (cont’d.)

Neither past due nor impaired Past due

but not Impaired

Bank Good satisfactory impaired financing Total

2020 RM’000 RM’000 RM’000 RM’000 RM’000

Term financing

- Home financing 4,501,078 89,050 184,885 91,069 4,866,082

- Syndicated financing 550,719 - - - 550,719

- Hire purchase

receivables 621,639 4,405 8,886 1,880 636,810

- Other term financing 8,115,317 26,053 56,289 56,067 8,253,726

Other financing 3,942,335 1,909 4,415 45,695 3,994,354

17,731,088 121,417 254,475 194,711 18,301,691

Less:

- Stage 1

- 12 Months ECL - - - - (94,984)

- Stage 2

- Lifetime ECL

not credit impaired - - - - (8,561)

- Stage 3

- Lifetime ECL

credit impaired - - - (87,944) (87,944)

Total net financing 17,731,088 121,417 254,475 106,767 18,110,202