Page 290 - Bank-Muamalat-Annual-Report-2021

P. 290

288 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

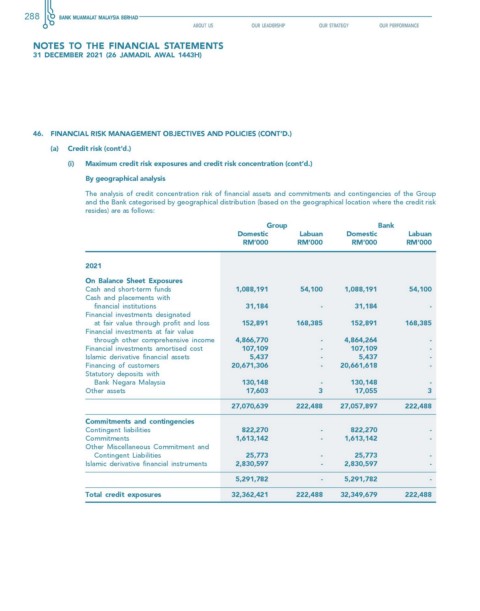

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

(i) Maximum credit risk exposures and credit risk concentration (cont’d.)

By geographical analysis

The analysis of credit concentration risk of financial assets and commitments and contingencies of the Group

and the Bank categorised by geographical distribution (based on the geographical location where the credit risk

resides) are as follows:

Group Bank

Domestic Labuan Domestic Labuan

rM’000 rM’000 rM’000 rM’000

2021

On Balance sheet exposures

Cash and short-term funds 1,088,191 54,100 1,088,191 54,100

Cash and placements with

financial institutions 31,184 - 31,184 -

Financial investments designated

at fair value through profit and loss 152,891 168,385 152,891 168,385

Financial investments at fair value

through other comprehensive income 4,866,770 - 4,864,264 -

Financial investments amortised cost 107,109 - 107,109 -

Islamic derivative financial assets 5,437 - 5,437 -

Financing of customers 20,671,306 - 20,661,618 -

Statutory deposits with

Bank Negara Malaysia 130,148 - 130,148 -

Other assets 17,603 3 17,055 3

27,070,639 222,488 27,057,897 222,488

commitments and contingencies

Contingent liabilities 822,270 - 822,270 -

Commitments 1,613,142 - 1,613,142 -

Other Miscellaneous Commitment and

Contingent Liabilities 25,773 - 25,773 -

Islamic derivative financial instruments 2,830,597 - 2,830,597 -

5,291,782 - 5,291,782 -

Total credit exposures 32,362,421 222,488 32,349,679 222,488