Page 296 - Bank-Muamalat-Annual-Report-2021

P. 296

294 bank MuaMalat Malaysia berhaD

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMbEr 2021 (26 JAMADIL AwAL 1443H)

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

(ii) credit quality for financing of customers (cont’d.)

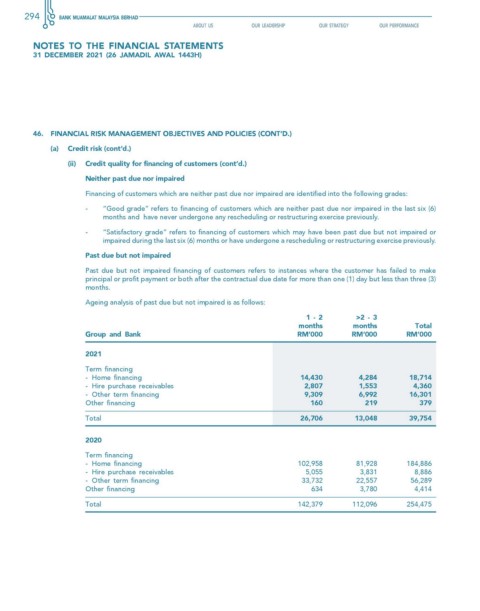

Neither past due nor impaired

Financing of customers which are neither past due nor impaired are identified into the following grades:

- “Good grade” refers to financing of customers which are neither past due nor impaired in the last six (6)

months and have never undergone any rescheduling or restructuring exercise previously.

- “Satisfactory grade” refers to financing of customers which may have been past due but not impaired or

impaired during the last six (6) months or have undergone a rescheduling or restructuring exercise previously.

Past due but not impaired

Past due but not impaired financing of customers refers to instances where the customer has failed to make

principal or profit payment or both after the contractual due date for more than one (1) day but less than three (3)

months.

Ageing analysis of past due but not impaired is as follows:

1 - 2 >2 - 3

months months total

Group and Bank RM’000 RM’000 RM’000

2021

Term financing

- Home financing 14,430 4,284 18,714

- Hire purchase receivables 2,807 1,553 4,360

- Other term financing 9,309 6,992 16,301

Other financing 160 219 379

Total 26,706 13,048 39,754

2020

Term financing

- Home financing 102,958 81,928 184,886

- Hire purchase receivables 5,055 3,831 8,886

- Other term financing 33,732 22,557 56,289

Other financing 634 3,780 4,414

Total 142,379 112,096 254,475