Page 299 - Bank-Muamalat-Annual-Report-2021

P. 299

ANNUAL REPORT 2021 297

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

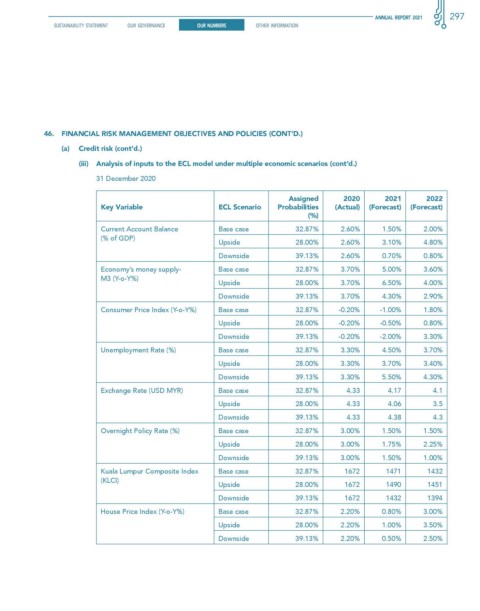

46. fINANcIAL RIsk MANAGeMeNT OBJecTIves AND POLIcIes (cONT’D.)

(a) credit risk (cont’d.)

(iii) Analysis of inputs to the ecL model under multiple economic scenarios (cont’d.)

31 December 2020

Assigned 2020 2021 2022

key variable ecL scenario Probabilities (Actual) (forecast) (forecast)

(%)

Current Account Balance Base case 32.87% 2.60% 1.50% 2.00%

(% of GDP)

Upside 28.00% 2.60% 3.10% 4.80%

Downside 39.13% 2.60% 0.70% 0.80%

Economy’s money supply- Base case 32.87% 3.70% 5.00% 3.60%

M3 (Y-o-Y%)

Upside 28.00% 3.70% 6.50% 4.00%

Downside 39.13% 3.70% 4.30% 2.90%

Consumer Price Index (Y-o-Y%) Base case 32.87% -0.20% -1.00% 1.80%

Upside 28.00% -0.20% -0.50% 0.80%

Downside 39.13% -0.20% -2.00% 3.30%

Unemployment Rate (%) Base case 32.87% 3.30% 4.50% 3.70%

Upside 28.00% 3.30% 3.70% 3.40%

Downside 39.13% 3.30% 5.50% 4.30%

Exchange Rate (USD MYR) Base case 32.87% 4.33 4.17 4.1

Upside 28.00% 4.33 4.06 3.5

Downside 39.13% 4.33 4.38 4.3

Overnight Policy Rate (%) Base case 32.87% 3.00% 1.50% 1.50%

Upside 28.00% 3.00% 1.75% 2.25%

Downside 39.13% 3.00% 1.50% 1.00%

Kuala Lumpur Composite Index Base case 32.87% 1672 1471 1432

(KLCI)

Upside 28.00% 1672 1490 1451

Downside 39.13% 1672 1432 1394

House Price Index (Y-o-Y%) Base case 32.87% 2.20% 0.80% 3.00%

Upside 28.00% 2.20% 1.00% 3.50%

Downside 39.13% 2.20% 0.50% 2.50%