Page 88 - Bank-Muamalat-AR2020

P. 88

86 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

About Us

ANNUAL REPORT FY2020

ECONOMIC

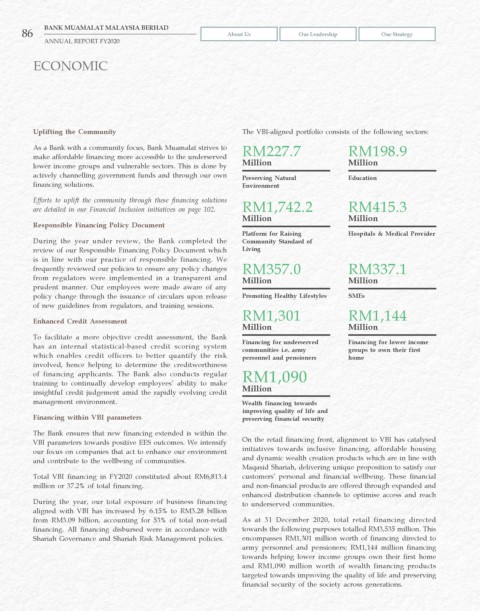

Uplifting the Community The VBI-aligned portfolio consists of the following sectors:

As a Bank with a community focus, Bank Muamalat strives to RM227.7 RM198.9

make affordable financing more accessible to the underserved

lower income groups and vulnerable sectors. This is done by Million Million

actively channelling government funds and through our own Preserving Natural Education

financing solutions. Environment

Efforts to uplift the community through these financing solutions

are detailed in our Financial Inclusion initiatives on page 102. RM1,742.2 RM415.3

Million Million

Responsible Financing Policy Document

Platform for Raising Hospitals & Medical Provider

During the year under review, the Bank completed the Community Standard of

review of our Responsible Financing Policy Document which Living

is in line with our practice of responsible financing. We

frequently reviewed our policies to ensure any policy changes RM357.0 RM337.1

from regulators were implemented in a transparent and Million Million

prudent manner. Our employees were made aware of any

policy change through the issuance of circulars upon release Promoting Healthy Lifestyles SMEs

of new guidelines from regulators, and training sessions.

RM1,301 RM1,144

Enhanced Credit Assessment

Million Million

To facilitate a more objective credit assessment, the Bank

has an internal statistical-based credit scoring system Financing for underserved Financing for lower income

communities i.e. army

groups to own their first

which enables credit officers to better quantify the risk personnel and pensioners home

involved, hence helping to determine the creditworthiness

of financing applicants. The Bank also conducts regular RM1,090

training to continually develop employees’ ability to make

insightful credit judgement amid the rapidly evolving credit Million

management environment. Wealth financing towards

improving quality of life and

Financing within VBI parameters preserving financial security

The Bank ensures that new financing extended is within the

VBI parameters towards positive EES outcomes. We intensify On the retail financing front, alignment to VBI has catalysed

our focus on companies that act to enhance our environment initiatives towards inclusive financing, affordable housing

and contribute to the wellbeing of communities. and dynamic wealth creation products which are in line with

Maqasid Shariah, delivering unique proposition to satisfy our

Total VBI financing in FY2020 constituted about RM6,813.4 customers’ personal and financial wellbeing. These financial

million or 37.2% of total financing. and non-financial products are offered through expanded and

enhanced distribution channels to optimise access and reach

During the year, our total exposure of business financing to underserved communities.

aligned with VBI has increased by 6.15% to RM3.28 billion

from RM3.09 billion, accounting for 53% of total non-retail As at 31 December 2020, total retail financing directed

financing. All financing disbursed were in accordance with towards the following purposes totalled RM3,535 million. This

Shariah Governance and Shariah Risk Management policies. encompasses RM1,301 million worth of financing directed to

army personnel and pensioners; RM1,144 million financing

towards helping lower income groups own their first home

and RM1,090 million worth of wealth financing products

targeted towards improving the quality of life and preserving

financial security of the society across generations.