Page 67 - Bank-Muamalat-AR2020

P. 67

65

Governance

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Islamic Estate Planning Strategies Moving Forward For Retail

Investment

Islamic Estate Planning has been a focus of Retail Investment during the year

to highlight the importance of having a wasiat, and we onboarded an additional • Provide an efficient digital-based

business partner to provide more choices to our customers. MyAngkasa and Awaris platform that satisfies customer

allow for digital registration with no additional costs for wasiat updates. This is experience

in line with our outlook towards digitalisation and providing affordable solutions • Maintain focus and further develop

to our customers. Total cases increased over 121% from the previous year to 631 gold as our “hero” product

cases reflecting an average of 53 cases a month as opposed to 32 cases a month in • Explore collaboration with other gold

FY2019.

vendors and suppliers to enhance

product offerings and expand the

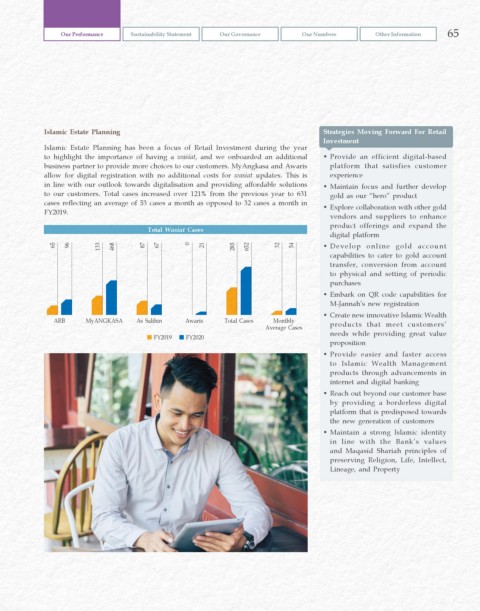

Total Wasiat Cases

digital platform

65 96 133 468 87 67 0 21 285 652 32 54 • Develop online gold account

capabilities to cater to gold account

transfer, conversion from account

to physical and setting of periodic

purchases

• Embark on QR code capabilities for

M-Jannah’s new registration

• Create new innovative Islamic Wealth

ARB MyANGKASA As Salihin Awaris Total Cases Monthly products that meet customers’

Average Cases

FY2019 FY2020 needs while providing great value

proposition

• Provide easier and faster access

to Islamic Wealth Management

products through advancements in

internet and digital banking

• Reach out beyond our customer base

by providing a borderless digital

platform that is predisposed towards

the new generation of customers

• Maintain a strong Islamic identity

in line with the Bank’s values

and Maqasid Shariah principles of

preserving Religion, Life, Intellect,

Lineage, and Property