Page 62 - Bank-Muamalat-AR2020

P. 62

60 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

About Us

ANNUAL REPORT FY2020

CONSUMER

BANKING

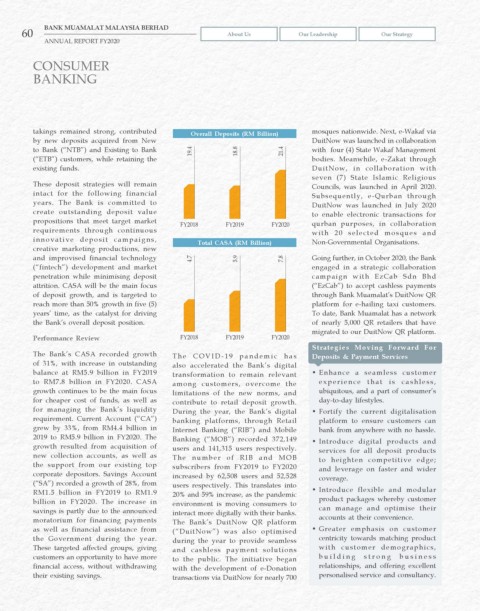

takings remained strong, contributed Overall Deposits (RM Billion) mosques nationwide. Next, e-Wakaf via

by new deposits acquired from New DuitNow was launched in collaboration

to Bank (“NTB”) and Existing to Bank 19.4 18.8 21.4 with four (4) State Wakaf Management

(“ETB”) customers, while retaining the bodies. Meanwhile, e-Zakat through

existing funds. DuitNow, in collaboration with

seven (7) State Islamic Religious

These deposit strategies will remain Councils, was launched in April 2020.

intact for the following financial Subsequently, e-Qurban through

years. The Bank is committed to DuitNow was launched in July 2020

create outstanding deposit value to enable electronic transactions for

propositions that meet target market FY2018 FY2019 FY2020 qurban purposes, in collaboration

requirements through continuous with 20 selected mosques and

innovative deposit campaigns, Total CASA (RM Billion) Non-Governmental Organisations.

creative marketing productions, new

and improvised financial technology 4.7 5.9 7.8 Going further, in October 2020, the Bank

(“fintech”) development and market engaged in a strategic collaboration

penetration while minimising deposit campaign with EzCab Sdn Bhd

attrition. CASA will be the main focus (“EzCab”) to accept cashless payments

of deposit growth, and is targeted to through Bank Muamalat’s DuitNow QR

reach more than 50% growth in five (5) platform for e-hailing taxi customers.

years’ time, as the catalyst for driving To date, Bank Muamalat has a network

the Bank’s overall deposit position. of nearly 5,000 QR retailers that have

migrated to our DuitNow QR platform.

Performance Review FY2018 FY2019 FY2020

Strategies Moving Forward For

The Bank’s CASA recorded growth The COVID-19 pandemic has Deposits & Payment Services

of 31%, with increase in outstanding also accelerated the Bank’s digital

balance at RM5.9 billion in FY2019 transformation to remain relevant • Enhance a seamless customer

to RM7.8 billion in FY2020. CASA among customers, overcome the experience that is cashless,

growth continues to be the main focus limitations of the new norms, and ubiquitous, and a part of consumer’s

for cheaper cost of funds, as well as contribute to retail deposit growth. day-to-day lifestyles.

for managing the Bank’s liquidity During the year, the Bank’s digital • Fortify the current digitalisation

requirement. Current Account (“CA”) banking platforms, through Retail platform to ensure customers can

grew by 33%, from RM4.4 billion in Internet Banking (“RIB”) and Mobile bank from anywhere with no hassle.

2019 to RM5.9 billion in FY2020. The Banking (“MOB”) recorded 372,149 • Introduce digital products and

growth resulted from acquisition of users and 141,315 users respectively. services for all deposit products

new collection accounts, as well as The number of RIB and MOB to heighten competitive edge;

the support from our existing top subscribers from FY2019 to FY2020 and leverage on faster and wider

corporate depositors. Savings Account increased by 62,508 users and 52,528 coverage.

(“SA”) recorded a growth of 28%, from users respectively. This translates into

RM1.5 billion in FY2019 to RM1.9 20% and 59% increase, as the pandemic • Introduce flexible and modular

billion in FY2020. The increase in environment is moving consumers to product packages whereby customer

savings is partly due to the announced interact more digitally with their banks. can manage and optimise their

moratorium for financing payments The Bank’s DuitNow QR platform accounts at their convenience.

as well as financial assistance from (“DuitNow”) was also optimised • Greater emphasis on customer

the Government during the year. during the year to provide seamless centricity towards matching product

These targeted affected groups, giving and cashless payment solutions with customer demographics,

customers an opportunity to have more to the public. The initiative began building strong bus iness

financial access, without withdrawing with the development of e-Donation relationships, and offering excellent

their existing savings. transactions via DuitNow for nearly 700 personalised service and consultancy.