Page 65 - Bank-Muamalat-AR2020

P. 65

63

Governance

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

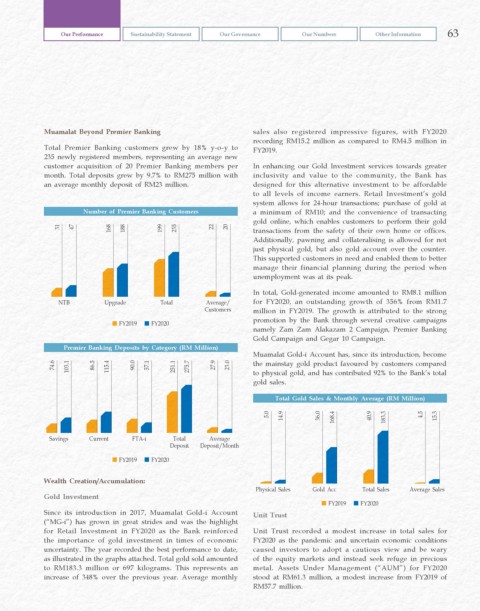

Muamalat Beyond Premier Banking sales also registered impressive figures, with FY2020

recording RM15.2 million as compared to RM4.5 million in

Total Premier Banking customers grew by 18% y-o-y to FY2019.

235 newly registered members, representing an average new

customer acquisition of 20 Premier Banking members per In enhancing our Gold Investment services towards greater

month. Total deposits grew by 9.7% to RM275 million with inclusivity and value to the community, the Bank has

an average monthly deposit of RM23 million. designed for this alternative investment to be affordable

to all levels of income earners. Retail Investment’s gold

system allows for 24-hour transactions; purchase of gold at

Number of Premier Banking Customers a minimum of RM10; and the convenience of transacting

gold online, which enables customers to perform their gold

31 47 168 188 199 235 22 20 transactions from the safety of their own home or offices.

Additionally, pawning and collateralising is allowed for not

just physical gold, but also gold account over the counter.

This supported customers in need and enabled them to better

manage their financial planning during the period when

unemployment was at its peak.

In total, Gold-generated income amounted to RM8.1 million

NTB Upgrade Total Average/ for FY2020, an outstanding growth of 356% from RM1.7

Customers million in FY2019. The growth is attributed to the strong

promotion by the Bank through several creative campaigns

FY2019 FY2020

namely Zam Zam Alakazam 2 Campaign, Premier Banking

Gold Campaign and Gegar 10 Campaign.

Premier Banking Deposits by Category (RM Million)

Muamalat Gold-i Account has, since its introduction, become

74.6 103.1 86.5 115.4 90.0 57.1 251.1 275.7 27.9 23.0 the mainstay gold product favoured by customers compared

to physical gold, and has contributed 92% to the Bank’s total

gold sales.

Total Gold Sales & Monthly Average (RM Million)

5.0 14.9 36.0 168.4 40.9 183.3 4.5 15.3

Savings Current FTA-i Total Average

Deposit Deposit/Month

FY2019 FY2020

Wealth Creation/Accumulation:

Physical Sales Gold Acc Total Sales Average Sales

Gold Investment

FY2019 FY2020

Since its introduction in 2017, Muamalat Gold-i Account Unit Trust

(“MG-i”) has grown in great strides and was the highlight

for Retail Investment in FY2020 as the Bank reinforced Unit Trust recorded a modest increase in total sales for

the importance of gold investment in times of economic FY2020 as the pandemic and uncertain economic conditions

uncertainty. The year recorded the best performance to date, caused investors to adopt a cautious view and be wary

as illustrated in the graphs attached. Total gold sold amounted of the equity markets and instead seek refuge in precious

to RM183.3 million or 697 kilograms. This represents an metal. Assets Under Management (“AUM”) for FY2020

increase of 348% over the previous year. Average monthly stood at RM61.3 million, a modest increase from FY2019 of

RM57.7 million.