Page 69 - Bank-Muamalat-AR2020

P. 69

67

Governance

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Performance Review

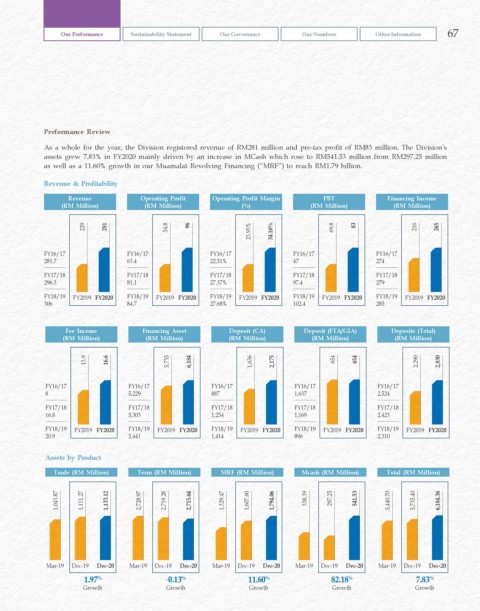

As a whole for the year, the Division registered revenue of RM281 million and pre-tax profit of RM83 million. The Division’s

assets grew 7.83% in FY2020 mainly driven by an increase in MCash which rose to RM541.53 million from RM297.25 million

as well as a 11.60% growth in our Muamalat Revolving Financing (“MRF”) to reach RM1.79 billion.

Revenue & Profitability

Revenue Operating Profit Operating Profit Margin PBT Financing Income

(RM Million) (RM Million) (%) (RM Million) (RM Million)

229 281 54.8 96 23.93% 34.16% 69.8 83 216 265

FY16/17 FY16/17 FY16/17 FY16/17 FY16/17

281.7 63.4 22.51% 47 274

FY17/18 FY17/18 FY17/18 FY17/18 FY17/18

296.3 81.1 27.37% 97.4 279

FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020

306 84.7 27.68% 102.4 285

Fee Income Financing Asset Deposit (CA) Deposit (FTA/GIA) Deposits (Total)

(RM Million) (RM Million) (RM Million) (RM Million) (RM Million)

13.9 16.6 5,735 6,184 1,636 2,175 654 654 2,290 2,830

FY16/17 FY16/17 FY16/17 FY16/17 FY16/17

8 5,229 887 1,637 2,524

FY17/18 FY17/18 FY17/18 FY17/18 FY17/18

16.8 5,303 1,254 1,169 2,423

FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020 FY18/19 FY2019 FY2020

20.9 5,441 1,414 896 2,310

Assets by Product

Trade (RM Million) Term (RM Million) MRF (RM Million) Mcash (RM Million) Total (RM Million)

1,043.87 1,111.27 1,133.12 2,728.97 2,719.28 2,715.64 1,329.47 1,607.60 1,794.06 338.39 297.25 541.53 5,440.70 5,735.40 6,184.36

Mar-19 Dec-19 Dec-20 Mar-19 Dec-19 Dec-20 Mar-19 Dec-19 Dec-20 Mar-19 Dec-19 Dec-20 Mar-19 Dec-19 Dec-20

1.97 % - 0.13 % 11.60 % 82.18 % 7.83 %

Growth Growth Growth Growth Growth