Page 63 - Bank-Muamalat-AR2020

P. 63

61

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Governance

RETAIL INVESTMENT Retail Investment offers a “one stop” complete Wealth Management ecosystem with

a comprehensive range of financial and non-financial solutions towards fulfilling its

mission to:

• Provide a unique proposition to satisfy customers’ personal and financial well

FOR FY2020,

RETAIL INVESTMENT being.

CONTRIBUTED • Maximise stakeholders’ wealth through multiple channels of distribution and

RM innovative product dynamics, in line with Maqasid Shariah.

24.75 MILLION • Establish trustworthy, professional and value-based advisory services that adhere

FEE-BASED INCOME to Shariah, Risk & Compliance parameters.

TO OVERALL BANK’S • Improve quality of life and preserve financial security of across generations.

REVENUE

• Embark on value-based initiatives to create financial access to all levels of society.

For instance, online gold transactions at minimal entry point of RM10.

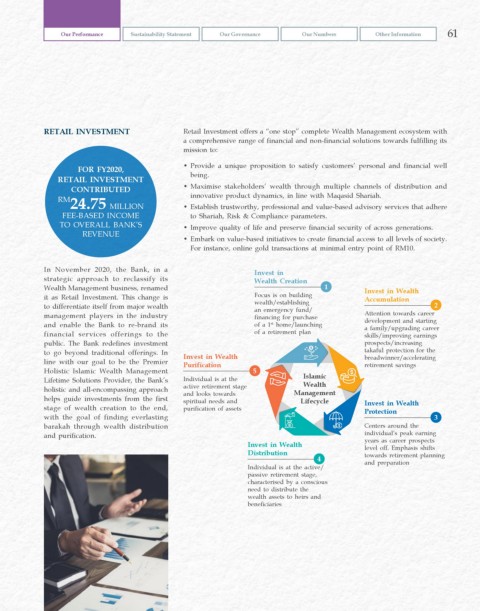

In November 2020, the Bank, in a Invest in

strategic approach to reclassify its Wealth Creation

Wealth Management business, renamed 1 Invest in Wealth

it as Retail Investment. This change is Focus is on building Accumulation

to differentiate itself from major wealth wealth/establishing 2

an emergency fund/

management players in the industry financing for purchase Attention towards career

and enable the Bank to re-brand its of a 1 home/launching development and starting

st

a family/upgrading career

financial services offerings to the of a retirement plan skills/improving earnings

public. The Bank redefines investment prospects/increasing

to go beyond traditional offerings. In Invest in Wealth takaful protection for the

line with our goal to be the Premier Purification breadwinner/accelerating

retirement savings

Holistic Islamic Wealth Management 5

Lifetime Solutions Provider, the Bank’s Individual is at the Islamic

Wealth

holistic and all-encompassing approach active retirement stage Management

helps guide investments from the first and looks towards Lifecycle

spiritual needs and

stage of wealth creation to the end, purification of assets Invest in Wealth

Protection

with the goal of finding everlasting 3

barakah through wealth distribution Centers around the

and purification. individual’s peak earning

Invest in Wealth years as career prospects

level off. Emphasis shifts

Distribution towards retirement planning

4 and preparation

Individual is at the active/

passive retirement stage,

characterised by a conscious

need to distribute the

wealth assets to heirs and

beneficiaries