Page 48 - Bank-Muamalat-AR2020

P. 48

46 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

Our Strategy

About Us

ANNUAL REPORT FY2020

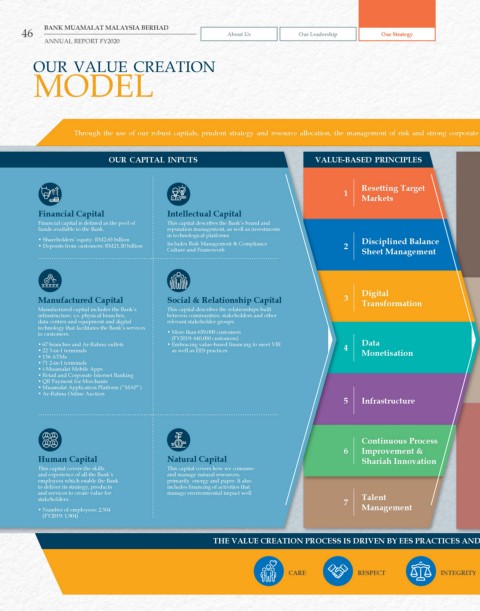

OUR VALUE CREATION

MODEL

Through the use of our robust capitals, prudent strategy and resource allocation, the management of risk and strong corporate governance - the Bank’s business model continues to deliver value for its stakeholders.

OUR CAPITAL INPUTS VALUE-BASED PRINCIPLES

Resetting Target

1

Markets

Financial Capital Intellectual Capital

Financial capital is defined as the pool of This capital describes the Bank’s brand and

funds available to the Bank. reputation management, as well as investments

in technological platforms

• Shareholders’ equity: RM2.65 billion Disciplined Balance

• Deposits from customers: RM21.50 billion Includes Risk Management & Compliance 2

Culture and Framework Sheet Management

Digital

Manufactured Capital Social & Relationship Capital 3 Transformation

Manufactured capital includes the Bank’s This capital describes the relationships built

infrastructure, i.e. physical branches, between communities, stakeholders and other

data centres and equipment and digital relevant stakeholder groups.

technology that facilitates the Bank’s services

to customers. • More than 659,000 customers

(FY2019: 640,000 customers)

• 67 branches and Ar-Rahnu outlets • Embracing value-based financing to meet VBI 4 Data

• 22 3-in-1 terminals as well as EES practices Monetisation

• 136 ATMs

• 71 2-in-1 terminals

• i-Muamalat Mobile Apps

• Retail and Corporate Internet Banking

• QR Payment for Merchants

• Muamalat Application Platform (“MAP”)

• Ar-Rahnu Online Auction

5 Infrastructure

Continuous Process

6 Improvement &

Human Capital Natural Capital Shariah Innovation

This capital covers the skills This capital covers how we consume

and experience of all the Bank’s and manage natural resources,

employees which enable the Bank primarily energy and paper. It also

to deliver its strategy, products includes financing of activities that

and services to create value for manage environmental impact well

stakeholders. Talent

7

• Number of employees: 2,304 Management

(FY2019: 1,904)

THE VALUE CREATION PROCESS IS DRIVEN BY EES PRACTICES AND ANCHORED BY THE BANK’S GOVERNANCE, RISK & COMPLIANCE

CARE RESPECT INTEGRITY