Page 47 - Bank-Muamalat-AR2020

P. 47

45

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

Governance

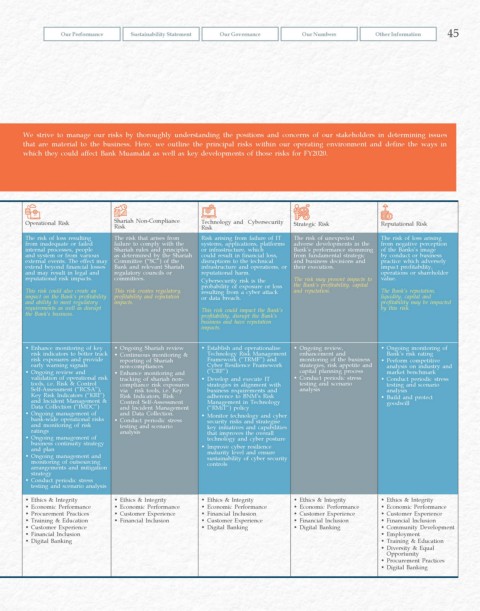

We strive to manage our risks by thoroughly understanding the positions and concerns of our stakeholders in determining issues

that are material to the business. Here, we outline the principal risks within our operating environment and define the ways in

which they could affect Bank Muamalat as well as key developments of those risks for FY2020.

Credit Risk Market Risk Rate of Return Risk Liquidity Risk Operational Risk Shariah Non-Compliance Technology and Cybersecurity Strategic Risk Reputational Risk

Risk

Risk

The risk of financial loss if a The risk of losses in on- and off- The risk of variability of assets and The risk of inability to fund any The risk of loss resulting The risk that arises from Risk arising from failure of IT The risk of unexpected The risk of loss arising

customer or counterparty fails balance sheet positions resulting liabilities arising from volatility of obligation on time as they fall from inadequate or failed failure to comply with the systems, applications, platforms adverse developments in the from negative perception

to meet its obligations. It is the from movements in market rates, market benchmark rates, impacting due, whether due to increase in internal processes, people Shariah rules and principles or infrastructure, which Bank’s performance stemming of the Banks’s image

primary source of risk to the Bank. foreign exchange rates, equity and portfolios both in the trading and asset or demand for funds from and system or from various as determined by the Shariah could result in financial loss, from fundamental strategic by conduct or business

commodity prices, which may banking books. Such changes may depositors. This ability has a external events. The effect may Committee (“SC”) of the disruptions to the technical and business decisions and practice which adversely

This risk may impact the Bank’s adversely impact earnings and adversely affect both earnings and serious implication on reputation extend beyond financial losses Bank and relevant Shariah infrastructure and operations, or their execution. impact profitability,

profitability, liquidity, asset quality capital positions. economic value. and continued existence. and may result in legal and regulatory councils or reputational harm. operations or shareholder

and reputation. reputational risk impacts. committees. Cybersecurity risk is the The risk may present impacts to value.

The risk may present an impact on The Bank’s capital, liquidity and The risk could impact the Bank’s probability of exposure or loss the Bank’s profitability, capital

the Bank’s profitability, liquidity and profitability may be impacted by the capital, liquidity, profitability, liquidity This risk could also create an This risk creates regulatory, resulting from a cyber attack and reputation. The Bank’s reputation,

capital. risk. and reputation. impact on the Bank’s profitability profitability and reputation or data breach. liquidity, capital and

and ability to meet regulatory impacts. profitability may be impacted

requirements as well as disrupt This risk could impact the Bank’s by this risk.

the Bank’s business. profitability, disrupt the Bank’s

business and have reputation

impacts.

• Enhance key risk indicators to • Develop hedging strategies • Develop hedging strategies • Enhance liquidity limits and • Enhance monitoring of key • Ongoing Shariah review • Establish and operationalise • Ongoing review, • Ongoing monitoring of

monitor emerging credit risk and against adverse price movements against adverse price movements strategy to manage and optimise risk indicators to better track • Continuous monitoring & Technology Risk Management enhancement and Bank’s risk rating

provide early warning signals • Enhance monitoring in market • Enhance monitoring in market liquidity position risk exposures and provide reporting of Shariah Framework (“TRMF”) and monitoring of the business • Perform competitive

• Ongoing review, enhancements risk limits risk limits • Enhance monitoring of key risk early warning signals non-compliances Cyber Resilience Framework strategies, risk appetite and analysis on industry and

and monitoring of risk appetite. • Enhance monitoring of key risk • Enhance monitoring of key risk indicators to better track risk • Ongoing review and • Enhance monitoring and (“CRF”) capital planning process market benchmark

• Enhance and tighten risk indicators to better track risk indicators to better track risk exposures and provide early validation of operational risk tracking of shariah non- • Develop and execute IT • Conduct periodic stress • Conduct periodic stress

acceptance criteria exposures and provide early exposures and provide early warning signals tools, i.e. Risk & Control compliance risk exposures strategies in alignment with testing and scenario testing and scenario

• Periodic review on credit warning signals warning signals • Enhance Liquidity Self-Assessment (“RCSA”), via risk tools, i.e. Key business requirements and analysis analysis

ratings/scoring • Diversification in pricing strategy • Diversification in pricing strategy Contingency Funding Plan to Key Risk Indicators (“KRI”) Risk Indicators, Risk adherence to BNM’s Risk • Build and protect

• Ongoing monitoring on • Conduct periodic stress testing • Conduct periodic stress testing manage liquidity crisis and Incident Management & Control Self-Assessment Management in Technology goodwill

Data Collection (“IMDC”)

collaterals, guarantees and risk and scenario analysis and scenario analysis • Ongoing monitoring of liquidity and Incident Management (“RMiT”) policy

limits • Enhance risk strategies and crisis early warning signals • Ongoing management of and Data Collection. • Monitor technology and cyber

• Conduct periodic stress testing monitoring in Asset and • Diversification in pricing strategy bank-wide operational risks • Conduct periodic stress security risks and strategise

and monitoring of risk

and scenario analysis Liabilities Management • Conduct periodic stress testing ratings testing and scenario key initiatives and capabilities

• Diversify into new market and scenario analysis • Ongoing management of analysis that improves the overall

segments for consumer financing business continuity strategy technology and cyber posture

• Streamline and enhance credit and plan • Improve cyber resilience

risk policies • Ongoing management and maturity level and ensure

monitoring of outsourcing sustainability of cyber security

controls

arrangements and mitigation

strategy

• Conduct periodic stress

testing and scenario analysis

• Ethics & Integrity • Ethics & Integrity • Ethics & Integrity • Ethics & Integrity • Ethics & Integrity • Ethics & Integrity • Ethics & Integrity • Ethics & Integrity • Ethics & Integrity

• Economic Performance • Economic Performance • Economic Performance • Economic Performance • Economic Performance • Economic Performance • Economic Performance • Economic Performance • Economic Performance

• Entrepreneur Development & • Financial Inclusion • Financial Inclusion • Financial Inclusion • Procurement Practices • Customer Experience • Financial Inclusion • Customer Experience • Customer Experience

Responsible Financing • Digital Banking • Digital Banking • Training & Education • Financial Inclusion • Customer Experience • Financial Inclusion • Financial Inclusion

• Customer Experience • Customer Experience • Digital Banking • Digital Banking • Community Development

• Financial Inclusion • Financial Inclusion • Employment

• Digital Banking • Digital Banking • Training & Education

• Diversity & Equal

Opportunity

• Procurement Practices

• Digital Banking