Page 49 - Bank-Muamalat-AR2020

P. 49

47

Governance

Our Performance Sustainability Statement Our Governance Our Numbers Other Information

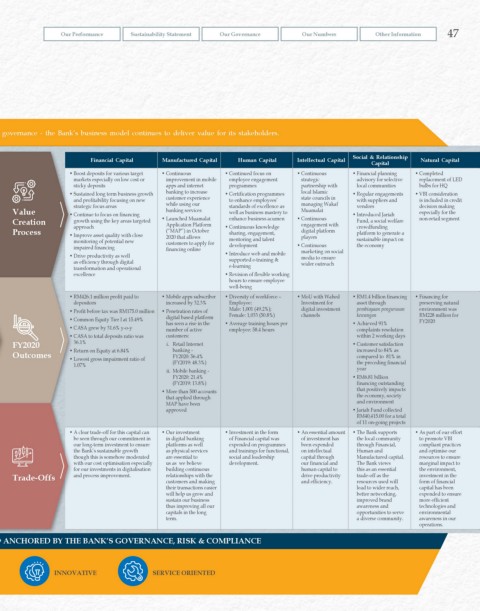

Through the use of our robust capitals, prudent strategy and resource allocation, the management of risk and strong corporate governance - the Bank’s business model continues to deliver value for its stakeholders.

Social & Relationship

Financial Capital Manufactured Capital Human Capital Intellectual Capital Natural Capital

Capital

• Boost deposits for various target • Continuous • Continued focus on • Continuous • Financial planning • Completed

markets especially on low cost or improvement in mobile employee engagement strategic advisory for selective replacement of LED

sticky deposits apps and internet programmes partnership with local communities bulbs for HQ

• Sustained long term business growth banking to increase • Certification programmes local Islamic • Regular engagements • VBI consideration

and profitability focusing on new customer experience to enhance employees’ state councils in with suppliers and is included in credit

strategic focus areas while using our standards of excellence as managing Wakaf vendors decision making

Value • Continue to focus on financing banking services well as business mastery to Muamalat • Introduced Jariah especially for the

Creation growth using the key areas targeted • Launched Muamalat enhance business acumen • Continuous Fund, a social welfare non-retail segment

engagement with

Application Platform

approach

Process • Improve asset quality with close (“MAP”) in October • Continuous knowledge digital platform crowdfunding

sharing, engagement,

platform to generate a

monitoring of potential new 2020 that allows mentoring and talent players sustainable impact on

customers to apply for

impaired financing financing online development • Continuous the economy

marketing on social

• Drive productivity as well • Introduce web and mobile media to ensure

as efficiency through digital supported e-training & wider outreach

transformation and operational e-learning

excellence • Revision of flexible working

hours to ensure employee

well-being

• RM426.1 million profit paid to • Mobile apps subscriber • Diversity of workforce – • MoU with Wahed • RM1.4 billion financing • Financing for

depositors increased by 32.3% Employee: Investment for asset through preserving natural

• Profit before tax was RM175.0 million • Penetration rates of Male: 1,001 (49.2%); digital investment pembiayaan pengurusan environment was

Female: 1,033 (50.8%)

kewangan

• Common Equity Tier I at 15.49% digital based platform • Average training hours per channels • Achieved 91% RM228 million for

FY2020

has seen a rise in the

• CASA grew by 31.6% y-o-y number of active employee: 58.4 hours complaints resolution

• CASA to total deposits ratio was customers: within 2 working days

FY2020 36.1% i. Retail Internet • Customer satisfaction

Outcomes • Return on Equity at 6.84% banking - increased to 84% as

FY2020: 56.4%

compared to 81% in

• Lowest gross impairment ratio of (FY2019: 48.3%) the preceding financial

1.07%

ii. Mobile banking - year

FY2020: 21.4% • RM6.81 billion

(FY2019: 13.8%) financing outstanding

• More than 500 accounts that positively impacts

that applied through the economy, society

MAP have been and environment

approved • Jariah Fund collected

RM40,415.00 for a total

of 11 on-going projects

• A clear trade-off for this capital can • Our investment • Investment in the form • An essential amount • The Bank supports • As part of our effort

be seen through our commitment in in digital banking of Financial capital was of investment has the local community to promote VBI

our long-term investment to ensure platforms as well expended on programmes been expended through Financial, compliant practices

the Bank’s sustainable growth as physical services and trainings for functional, on intellectual Human and and optimise our

though this is somehow moderated are essential to social and leadership capital through Manufactured capital. resources to ensure

with our cost optimisation especially us as we believe development. our financial and The Bank views marginal impact to

for our investments in digitalisation building continuous human capital to this as an essential the environment,

Trade-Offs and process improvement. relationships with the drive productivity trade-off as the investment in the

form of financial

resources used will

and efficiency.

customers and making

their transactions easier lead to wider reach, capital has been

will help us grow and better networking, expended to ensure

sustain our business improved brand more efficient

thus improving all our awareness and technologies and

capitals in the long opportunities to serve environmental

term. a diverse community. awareness in our

operations.

THE VALUE CREATION PROCESS IS DRIVEN BY EES PRACTICES AND ANCHORED BY THE BANK’S GOVERNANCE, RISK & COMPLIANCE

INTEGRITY INNOVATIVE SERVICE ORIENTED