Page 369 - Bank-Muamalat-AR2020

P. 369

367

Our Performance Sustainability Statement Governance Our Numbers Other Information

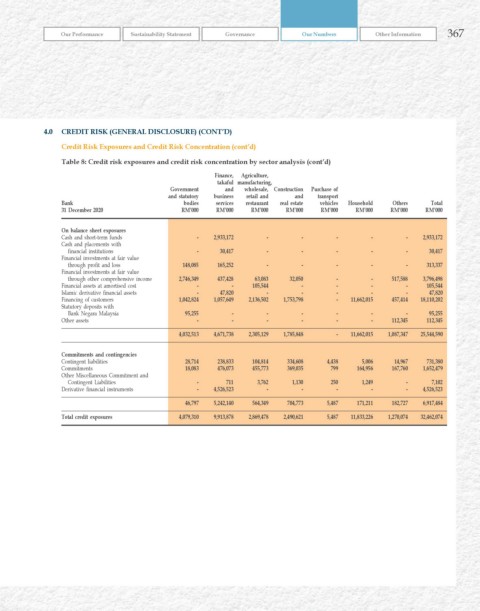

4.0 CrEDIT rISk (GENErAL DISCLOSurE) (CONT’D)

Credit risk Exposures and Credit risk Concentration (cont’d)

Table 8: Credit risk exposures and credit risk concentration by sector analysis (cont’d)

Finance, Agriculture,

takaful manufacturing,

Government and wholesale, Construction Purchase of

and statutory business retail and and transport

Bank bodies services restaurant real estate vehicles household Others Total

31 December 2020 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

On balance sheet exposures

Cash and short-term funds - 2,933,172 - - - - - 2,933,172

Cash and placements with

financial institutions - 30,417 - - - - - 30,417

Financial investments at fair value

through profit and loss 148,085 165,252 - - - - - 313,337

Financial investments at fair value

through other comprehensive income 2,746,349 437,428 63,083 32,050 - - 517,588 3,796,498

Financial assets at amortised cost - - 105,544 - - - - 105,544

Islamic derivative financial assets - 47,820 - - - - - 47,820

Financing of customers 1,042,824 1,057,649 2,136,502 1,753,798 - 11,662,015 457,414 18,110,202

Statutory deposits with

Bank Negara Malaysia 95,255 - - - - - - 95,255

Other assets - - - - - - 112,345 112,345

4,032,513 4,671,738 2,305,129 1,785,848 - 11,662,015 1,087,347 25,544,590

Commitments and contingencies

Contingent liabilities 28,714 238,833 104,814 334,608 4,438 5,006 14,967 731,380

Commitments 18,083 476,073 455,773 369,035 799 164,956 167,760 1,652,479

Other Miscellaneous Commitment and

Contingent Liabilities - 711 3,762 1,130 250 1,249 - 7,102

Derivative financial instruments - 4,526,523 - - - - - 4,526,523

46,797 5,242,140 564,349 704,773 5,487 171,211 182,727 6,917,484

Total credit exposures 4,079,310 9,913,878 2,869,478 2,490,621 5,487 11,833,226 1,270,074 32,462,074