Page 368 - Bank-Muamalat-AR2020

P. 368

366 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

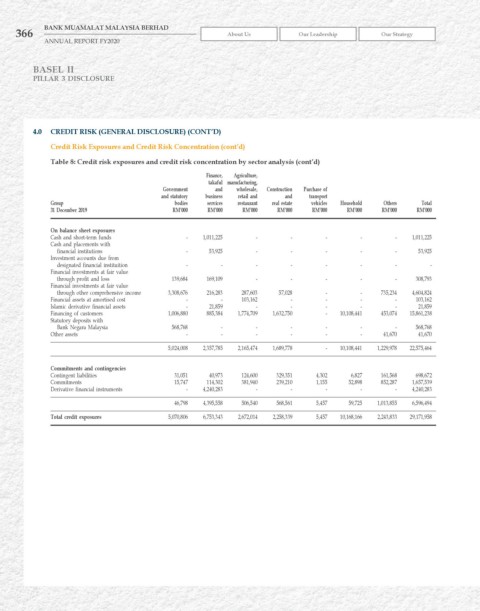

4.0 CrEDIT rISk (GENErAL DISCLOSurE) (CONT’D)

Credit risk Exposures and Credit risk Concentration (cont’d)

Table 8: Credit risk exposures and credit risk concentration by sector analysis (cont’d)

Finance, Agriculture,

takaful manufacturing,

Government and wholesale, Construction Purchase of

and statutory business retail and and transport

Group bodies services restaurant real estate vehicles household Others Total

31 December 2019 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

On balance sheet exposures

Cash and short-term funds - 1,011,225 - - - - - 1,011,225

Cash and placements with

financial institutions - 53,925 - - - - - 53,925

Investment accounts due from

designated financial instituition - - - - - - - -

Financial investments at fair value

through profit and loss 139,684 169,109 - - - - - 308,793

Financial investments at fair value

through other comprehensive income 3,308,676 216,283 287,603 57,028 - - 735,234 4,604,824

Financial assets at amortised cost - - 103,162 - - - - 103,162

Islamic derivative financial assets - 21,859 - - - - - 21,859

Financing of customers 1,006,880 885,384 1,774,709 1,632,750 - 10,108,441 453,074 15,861,238

Statutory deposits with

Bank Negara Malaysia 568,768 - - - - - - 568,768

Other assets - - - - - - 41,670 41,670

5,024,008 2,357,785 2,165,474 1,689,778 - 10,108,441 1,229,978 22,575,464

Commitments and contingencies

Contingent liabilities 31,051 40,973 124,600 329,351 4,302 6,827 161,568 698,672

Commitments 15,747 114,302 381,940 239,210 1,155 52,898 852,287 1,657,539

Derivative financial instruments - 4,240,283 - - - - - 4,240,283

46,798 4,395,558 506,540 568,561 5,457 59,725 1,013,855 6,596,494

Total credit exposures 5,070,806 6,753,343 2,672,014 2,258,339 5,457 10,168,166 2,243,833 29,171,958