Page 364 - Bank-Muamalat-AR2020

P. 364

362 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

3.0 rISk MANAGEMENT (CONT’D)

The Board’s primary oversight role is to understand the risks undertaken by the Bank and ensure that these risks are properly

managed. While the Board is ultimately responsible for the Bank’s management of risks, it has entrusted the Board Risk

Management Committee (“BRMC”) to carry out specific risk management oversight functions on its behalf.

BRMC, which is chaired by an independent director of the Board, is a board-level committee that oversees the overall

management of risks and deliberates on risk-related issues and resolutions. The BRMC, acting on behalf of the Board, also

ensures that the appropriate processes, resources, policies and guidelines are in place to manage the Bank’s risks.

In addition, the Board is also supported by the Shariah Committee (“SC”), which was set up as an independent external body

to decide on Shariah issues and to simultaneously assist towards risk mitigation and compliance with the Shariah principles.

The execution of the board-approved risk strategies and policies is the responsibility of the Bank’s management and these

functions are also exercised under a committee structure. Heading the management-level risk committees is the Executive Risk

Management Committee (“ERMC”), which is chaired by the Chief Executive Officer (“CEO”). The ERMC focuses on the overall

business strategies and the Bank’s day-to-day operations in respect of risk management.

Other management-level risk committees are set up to oversee specific risk areas and its related control functions as described

below:

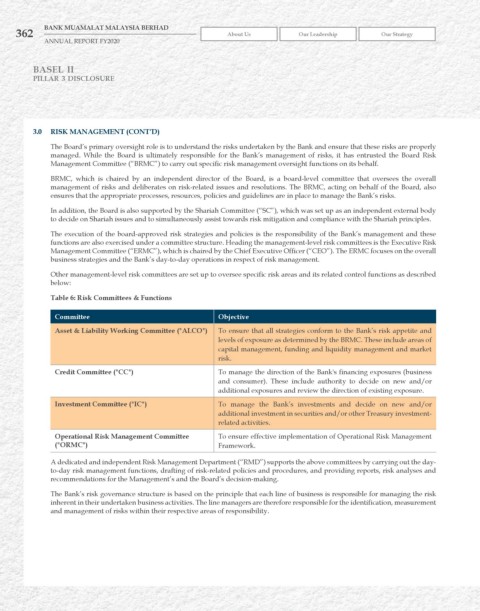

Table 6: risk Committees & Functions

Committee Objective

Asset & Liability working Committee ("ALCO") To ensure that all strategies conform to the Bank’s risk appetite and

levels of exposure as determined by the BRMC. These include areas of

capital management, funding and liquidity management and market

risk.

Credit Committee ("CC") To manage the direction of the Bank's financing exposures (business

and consumer). These include authority to decide on new and/or

additional exposures and review the direction of existing exposure.

Investment Committee ("IC") To manage the Bank’s investments and decide on new and/or

additional investment in securities and/or other Treasury investment-

related activities.

Operational risk Management Committee To ensure effective implementation of Operational Risk Management

("OrMC") Framework.

A dedicated and independent Risk Management Department (“RMD”) supports the above committees by carrying out the day-

to-day risk management functions, drafting of risk-related policies and procedures, and providing reports, risk analyses and

recommendations for the Management’s and the Board’s decision-making.

The Bank’s risk governance structure is based on the principle that each line of business is responsible for managing the risk

inherent in their undertaken business activities. The line managers are therefore responsible for the identification, measurement

and management of risks within their respective areas of responsibility.