Page 360 - Bank-Muamalat-AR2020

P. 360

358 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

2.1 INTErNAL CAPITAL ADEquACy ASSESSMENT PrOCESS (“ICAAP”) (CONT’D)

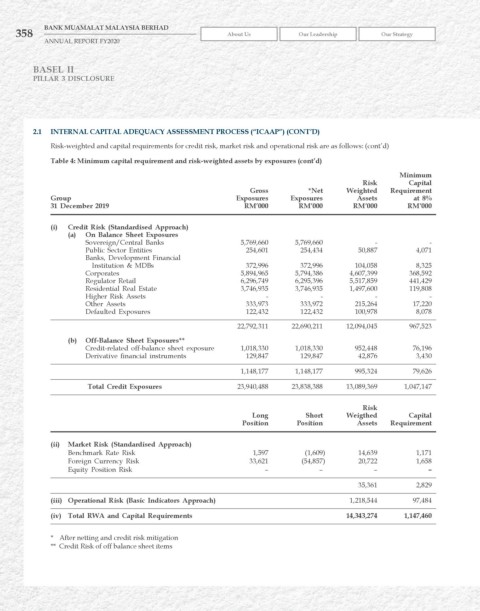

Risk-weighted and capital requirements for credit risk, market risk and operational risk are as follows: (cont’d)

Table 4: Minimum capital requirement and risk-weighted assets by exposures (cont’d)

Minimum

risk Capital

Gross *Net weighted requirement

Group Exposures Exposures Assets at 8%

31 December 2019 rM’000 rM’000 rM’000 rM’000

(i) Credit risk (Standardised Approach)

(a) On Balance Sheet Exposures

Sovereign/Central Banks 5,769,660 5,769,660 - -

Public Sector Entities 254,601 254,434 50,887 4,071

Banks, Development Financial

Institution & MDBs 372,996 372,996 104,058 8,325

Corporates 5,894,965 5,794,386 4,607,399 368,592

Regulator Retail 6,296,749 6,295,396 5,517,859 441,429

Residential Real Estate 3,746,935 3,746,935 1,497,600 119,808

Higher Risk Assets - - - -

Other Assets 333,973 333,972 215,264 17,220

Defaulted Exposures 122,432 122,432 100,978 8,078

22,792,311 22,690,211 12,094,045 967,523

(b) Off-Balance Sheet Exposures**

Credit-related off-balance sheet exposure 1,018,330 1,018,330 952,448 76,196

Derivative financial instruments 129,847 129,847 42,876 3,430

1,148,177 1,148,177 995,324 79,626

Total Credit Exposures 23,940,488 23,838,388 13,089,369 1,047,147

risk

Long Short weigthed Capital

Position Position Assets requirement

(ii) Market risk (Standardised Approach)

Benchmark Rate Risk 1,597 (1,609) 14,639 1,171

Foreign Currency Risk 33,621 (54,857) 20,722 1,658

Equity Position Risk – – – –

35,361 2,829

(iii) Operational risk (Basic Indicators Approach) 1,218,544 97,484

(iv) Total rwA and Capital requirements 14,343,274 1,147,460

* After netting and credit risk mitigation

** Credit Risk of off balance sheet items