Page 358 - Bank-Muamalat-AR2020

P. 358

356 BANK MUAMALAT MALAYSIA BERHAD About Us Our Leadership Our Strategy

ANNUAL REPORT FY2020

BASEL II

PILLAr 3 DISCLOSurE

2.1 INTErNAL CAPITAL ADEquACy ASSESSMENT PrOCESS (“ICAAP”) (CONT’D)

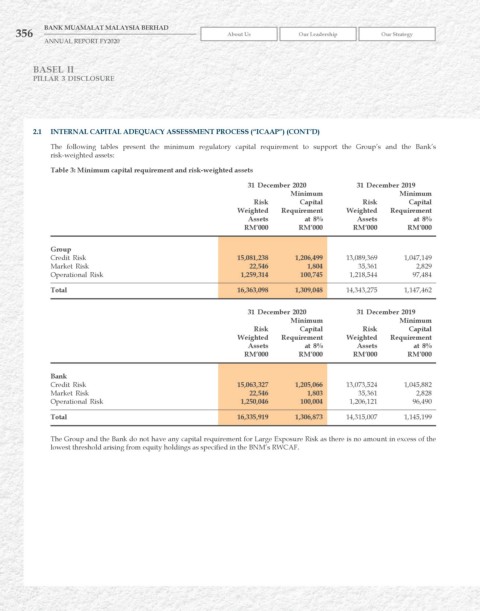

The following tables present the minimum regulatory capital requirement to support the Group’s and the Bank’s

risk-weighted assets:

Table 3: Minimum capital requirement and risk-weighted assets

31 December 2020 31 December 2019

Minimum Minimum

risk Capital risk Capital

weighted requirement weighted requirement

Assets at 8% Assets at 8%

rM’000 rM’000 rM’000 rM’000

Group

Credit Risk 15,081,238 1,206,499 13,089,369 1,047,149

Market Risk 22,546 1,804 35,361 2,829

Operational Risk 1,259,314 100,745 1,218,544 97,484

Total 16,363,098 1,309,048 14,343,275 1,147,462

31 December 2020 31 December 2019

Minimum Minimum

risk Capital risk Capital

weighted requirement weighted requirement

Assets at 8% Assets at 8%

rM’000 rM’000 rM’000 rM’000

Bank

Credit Risk 15,063,327 1,205,066 13,073,524 1,045,882

Market Risk 22,546 1,803 35,361 2,828

Operational Risk 1,250,046 100,004 1,206,121 96,490

Total 16,335,919 1,306,873 14,315,007 1,145,199

The Group and the Bank do not have any capital requirement for Large Exposure Risk as there is no amount in excess of the

lowest threshold arising from equity holdings as specified in the BNM’s RWCAF.