Page 363 - Bank-Muamalat-AR2020

P. 363

361

Our Performance Sustainability Statement Governance Our Numbers Other Information

3.0 rISk MANAGEMENT

Overview

Risk is inherent in every aspect of our business activity and to manage this effectively, BMMB has undertaken an integrated risk

management approach to ensure that a broad spectrum of risk types are considered and addressed. The Bank’s risk management

framework and structure are built on formal governance processes that outline responsibilities for risk management activities,

as well as the governance and oversight of these activities.

An integral part of this approach is the systematic process of risk identification and measurement. Appropriate risk management

strategies are then developed in line with the Bank’s business plans and objectives, which include the ongoing monitoring and

control of the identified risk exposures. The management and control over the principal risk areas of credit, market, asset and

liability management, operational and Shariah are integrated to optimize and secure the Bank’s strategic and competitive

advantage.

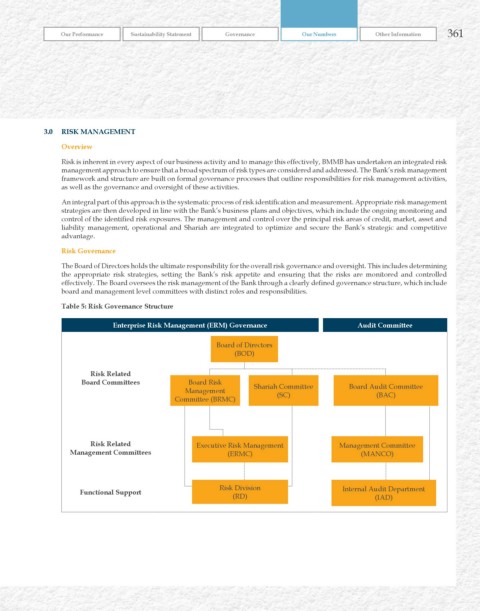

risk Governance

The Board of Directors holds the ultimate responsibility for the overall risk governance and oversight. This includes determining

the appropriate risk strategies, setting the Bank’s risk appetite and ensuring that the risks are monitored and controlled

effectively. The Board oversees the risk management of the Bank through a clearly defined governance structure, which include

board and management level committees with distinct roles and responsibilities.

Table 5: risk Governance Structure

Enterprise risk Management (ErM) Governance Audit Committee

Board of Directors

(BOD)

risk related

Board Committees Board Risk

Management Shariah Committee Board Audit Committee

Committee (BRMC) (SC) (BAC)

risk related Executive Risk Management Management Committee

Management Committees (ERMC) (MANCO)

Risk Division Internal Audit Department

Functional Support

(RD) (IAD)