Page 365 - Bank-Muamalat-AR2020

P. 365

363

Our Performance Sustainability Statement Governance Our Numbers Other Information

3.0 rISk MANAGEMENT (CONT’D)

The risk governance framework is implemented under a “distributed function” approach where risk is being managed based

on the three lines of defense model. The components and their respective roles are as described below:

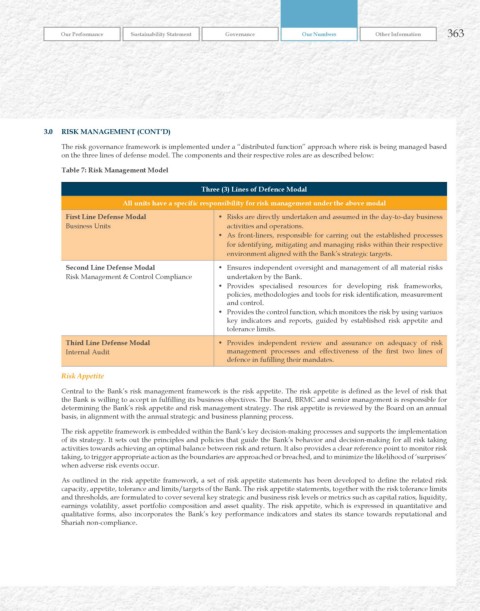

Table 7: risk Management Model

Three (3) Lines of Defence Modal

All units have a specific responsibility for risk management under the above modal

First Line Defense Modal • Risks are directly undertaken and assumed in the day-to-day business

Business Units activities and operations.

• As front-liners, responsible for carring out the established processes

for identifying, mitigating and managing risks within their respective

environment aligned with the Bank’s strategic targets.

Second Line Defense Modal • Ensures independent oversight and management of all material risks

Risk Management & Control Compliance undertaken by the Bank.

• Provides specialised resources for developing risk frameworks,

policies, methodologies and tools for risk identification, measurement

and control.

• Provides the control function, which monitors the risk by using variuos

key indicators and reports, guided by established risk appetite and

tolerance limits.

Third Line Defense Modal • Provides independent review and assurance on adequacy of risk

Internal Audit management processes and effectiveness of the first two lines of

defence in fufilling their mandates.

Risk Appetite

Central to the Bank’s risk management framework is the risk appetite. The risk appetite is defined as the level of risk that

the Bank is willing to accept in fulfilling its business objectives. The Board, BRMC and senior management is responsible for

determining the Bank’s risk appetite and risk management strategy. The risk appetite is reviewed by the Board on an annual

basis, in alignment with the annual strategic and business planning process.

The risk appetite framework is embedded within the Bank’s key decision-making processes and supports the implementation

of its strategy. It sets out the principles and policies that guide the Bank’s behavior and decision-making for all risk taking

activities towards achieving an optimal balance between risk and return. It also provides a clear reference point to monitor risk

taking, to trigger appropriate action as the boundaries are approached or breached, and to minimize the likelihood of ‘surprises’

when adverse risk events occur.

As outlined in the risk appetite framework, a set of risk appetite statements has been developed to define the related risk

capacity, appetite, tolerance and limits/targets of the Bank. The risk appetite statements, together with the risk tolerance limits

and thresholds, are formulated to cover several key strategic and business risk levels or metrics such as capital ratios, liquidity,

earnings volatility, asset portfolio composition and asset quality. The risk appetite, which is expressed in quantitative and

qualitative forms, also incorporates the Bank’s key performance indicators and states its stance towards reputational and

Shariah non-compliance.