Page 69 - Bank-Muamalat_Annual-Report-2023

P. 69

ANNUAL REPORT 2023

OUR BUSINESS PERFORMANCE

TRANSACTION

BANKING

Total Deposits In FY2023 a significant transformation occurred within

RM17.27 billion the Transaction Banking Division (TBD), shifting its focus

(18% YoY) from the traditional model of Non-Retail deposit and

Trade Finance pillars to strategically prioritising Retail

deposit and Non-Retail deposits business under one roof.

Trade business responsibilities were delegated to Commercial Banking, allowing TBD

to concentrate more on deposit endeavours to bolster liquidity, fortify customer

relationships, and foster sustainable long-term growth. This new strategic focus has

resulted in a significant deposit growth of 18%, equivalent to RM2.65 billion,

which led to total deposits of RM17.27 billion.

PERFORMANCE REVIEW for SSi was launched on 8 August 2023, and ran until

29 February 2024. Despite the relatively short duration of the

In 2023, TBD embraced digital transformation and campaign, TBD successfully closed RM98 million in deposits

implemented innovative digital solutions for cash by 31 December 2023. Additionally, TBD pursued other

management, and payments while improving customer strategic initiatives, such as enhancing the Muamalat Salary

experience and loyalty. Aligned with the Bank’s digitalisation Scheme, implementing the Pensioner Account Programme,

journey, TBD launched VISA Business to Business Connect and introducing the Fantastic Pocket as a short-term strategy

(VISA B2BC), highlighting its standout feature of near to elevate performance by the year’s end.

real time value whereby Foreign Telegraphic Transfer

(FTT) transactions processed through Visa B2B Connect is As a result, robust growth was recorded for Fixed-Term and

delivered to recipients within an hour. A milestone was Current Accounts. Specifically, Fixed-Term Accounts saw

reached as the Bank became the first Bank in Malaysia to utilise significant growth of 27% or RM1.45 billion, followed by

Visa’s payment networks. Current Accounts which had a notable increase of 17.9%

or RM1.31 billion. However, due to market challenges

TBD continued to implement various proactive key strategies and increased competition, Savings Accounts witnessed a

aimed at driving growth which has effectively spurred growth slight decrease of RM52 million, while Investment

within the division. One of these involved boosting Retail Accounts declined by RM53 million due to impacts on the

Deposit growth through the introduction of a new flagship retail segment.

product called Sijil Simpanan Islamik (SSi). The campaign

Deposit by Product

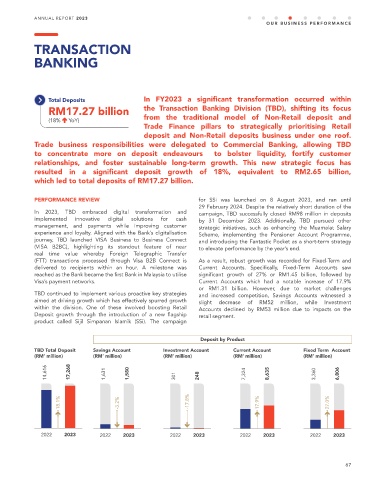

TBD Total Deposit Savings Account Investment Account Current Account Fixed Term Account

(RM’ million) (RM’ million) (RM’ million) (RM’ million) (RM’ million)

14,616 17,268 1,631 1,580 301 248 7,324 8,635 3,360 6,806

18.1% -3.2% -17.8% 17.9% 27.0%

2022 2023 2022 2023 2022 2023 2022 2023 2022 2023

67