Page 68 - Bank-Muamalat_Annual-Report-2023

P. 68

BANK MUAMALAT MALAYSIA BERHAD

COMMERCIAL

BANKING

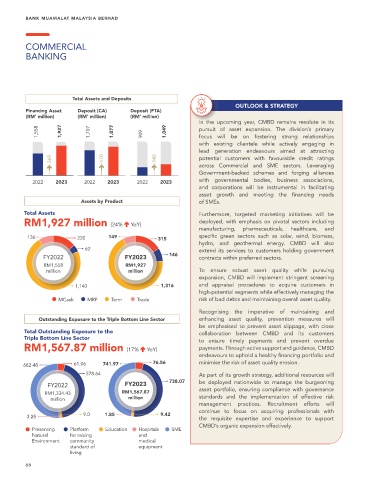

Total Assets and Deposits

OUTLOOK & STRATEGY

Financing Asset Deposit (CA) Deposit (FTA)

(RM’ million) (RM’ million) (RM’ million)

In the upcoming year, CMBD remains resolute in its

1,558 1,927 1,707 1,877 909 1,049 pursuit of asset expansion. The division’s primary

focus will be on fostering strong relationships

with existing clientele while actively engaging in

lead generation endeavours aimed at attracting

369 170 140 potential customers with favourable credit ratings

across Commercial and SME sectors. Leveraging

Government-backed schemes and forging alliances

with governmental bodies, business associations,

2022 2023 2022 2023 2022 2023

and corporations will be instrumental in facilitating

asset growth and meeting the financing needs

Assets by Product of SMEs.

Total Assets Furthermore, targeted marketing initiatives will be

deployed, with emphasis on pivotal sectors including

RM1,927 million (24% YoY)

manufacturing, pharmaceuticals, healthcare, and

136 220 149 315 specific green sectors such as solar, wind, biomass,

hydro, and geothermal energy. CMBD will also

62 extend its services to customers holding government

FY2022 FY2023 146 contracts within preferred sectors.

RM1,558 RM1,927

million million To ensure robust asset quality while pursuing

expansion, CMBD will implement stringent screening

1,140 1,316 and appraisal procedures to acquire customers in

high-potential segments while effectively managing the

n MCash n MRF n Term n Trade risk of bad debts and maintaining overall asset quality.

Recognising the imperative of maintaining and

Outstanding Exposure to the Triple Bottom Line Sector enhancing asset quality, prevention measures will

be emphasised to prevent asset slippage, with close

Total Outstanding Exposure to the collaboration between CMBD and its customers

Triple Bottom Line Sector

to ensure timely payments and prevent overdue

RM1,567.87 million (17% YoY) payments. Through active support and guidance, CMBD

endeavours to uphold a healthy financing portfolio and

682.48 61.06 741.97 76.56 minimise the risk of asset quality erosion.

578.64 As part of its growth strategy, additional resources will

738.07 be deployed nationwide to manage the burgeoning

FY2022 FY2023

asset portfolio, ensuring compliance with governance

RM1,334.43 RM1,567.87

million million standards and the implementation of effective risk

management practices. Recruitment efforts will

continue to focus on acquiring professionals with

3.25 9.0 1.85 9.42

the requisite expertise and experience to support

CMBD’s organic expansion effectively.

n Preserving n Platform n Education n Hospitals n SME

Natural for raising and

Environment community medical

standard of equipment

living

66