Page 67 - Bank-Muamalat_Annual-Report-2023

P. 67

ANNUAL REPORT 2023

OUR BUSINESS PERFORMANCE

COMMERCIAL

BANKING

Revenue The Commercial Banking Division (CMBD) holds principal

RM103.4 responsibility for managing the financing needs of a diverse

clientele, encompassing state-owned agencies, commercial

million enterprises, and small and medium-sized enterprises (SMEs).

(48.8% YoY)

CMBD provides a comprehensive suite of financial products and

services, spanning both short- and long-term financing solutions

such as working capital, project funding, and trade finance. As of 31 December 2023,

CMBD oversaw a total asset portfolio valued at RM1,927 million, with 77% allocated

to commercial financing clients and 23% to Retail SME financing clients.

PERFORMANCE REVIEW essential for a thriving economy. Financing for initiatives

aimed at raising community standards of living witnessed a

In FY2023, the Bank’s CMBD targeted to expand its assets 28% increase, showcasing CMBD’s commitment to societal

and market share within a competitive banking landscape impact.

dominated by larger banks. The challenging market

condition was marked by an increase in the Overnight Policy CMBD’s ongoing collaboration with the Pahang State

Rate (OPR) from 2.75% to 3% in May 2023. Within this Government on Phase 2 of the Skim Pembiayaan Mikro

environment, CMDB remained vigilant through proactive Negeri Pahang (i-PUSH), continued to be popular,

monitoring of its asset quality, prudently managing its with 1,521 customers onboarded during the fiscal year.

credit risks in its financing portfolios and maintaining asset This micro-financing scheme is aimed at providing financial

quality proactively, with a focus on selectively acquiring support to underserved communities by empowering

creditworthy customers. Through strategic initiatives, including underserved individuals and businesses nationwide. This

personalised approaches to attract and retain high-quality commitment to financial inclusion is driving the Bank’s

clients, CMBD successfully broadened its customer base pursuit of similar collaborations with other state governments.

and met its growth targets.

As CMBD looks ahead, its commitment to sustainability

Financially, CMBD experienced significant revenue growth and long-term growth remains unwavering. The division

in FY2023, attributed to a RM369 million increase in will continue to monitor economic trends closely and adapt

assets and a RM312 million rise in total deposits. Notably, its strategies accordingly to navigate evolving market

there was a 135% surge in the Managed Retail Funds (MRF) conditions successfully.

segment during the year. Deposit expansion was primarily

driven by current accounts (CA) which brought in Financial Results

RM170 million. Profit Before Tax (PBT) for FY2023 stood

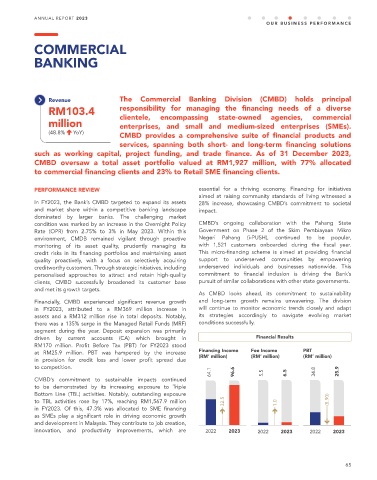

at RM25.9 million. PBT was hampered by the increase Financing Income Fee Income PBT

(RM’ million) (RM’ million) (RM’ million)

in provision for credit loss and lower profit spread due

to competition.

64.1 96.6 5.5 6.5 34.8 25.9

CMBD’s commitment to sustainable impacts continued

to be demonstrated by its increasing exposure to Triple

Bottom Line (TBL) activities. Notably, outstanding exposure

32.5 1.0

to TBL activities rose by 17%, reaching RM1,567.9 million (8.90)

in FY2023. Of this, 47.3% was allocated to SME financing

as SMEs play a significant role in driving economic growth

and development in Malaysia. They contribute to job creation,

innovation, and productivity improvements, which are 2022 2023 2022 2023 2022 2023

65