Page 74 - Bank-Muamalat_Annual-Report-2023

P. 74

BANK MUAMALAT MALAYSIA BERHAD

SUBSIDIARY:

MUAMALAT INVEST SDN BHD

Revenue Muamalat Invest Sdn. Bhd. (MISB), an Islamic fund management

RM3.90 subsidiary of Bank Muamalat, was established in 2006 and

licensed in 2010. MISB’s primary role is to serve institutional

million and high-net-worth investors by offering a comprehensive

(5.12% YoY)

range of Shariah-compliant investment management services.

These services span a wide array of capital market products,

including discretionary and non-discretionary mandates, as well as wholesale and retail

investment solutions. The managed portfolios of investments are diversified across

various asset classes such as Islamic money market instruments, equities, and Sukuk.

In 2023, the substantial decline in Assets Under Management (AUM) was influenced

by the removal of tax benefit from money market funds, which have no material impact

to the revenue of MISB. On the back of underwhelming domestic market during the

period under review, MISB emerged as one of the top performers in the domestic

equity Shariah strategy in Malaysia, and showed positive performance overall in its

sukuk funds.

PERFORMANCE REVIEW

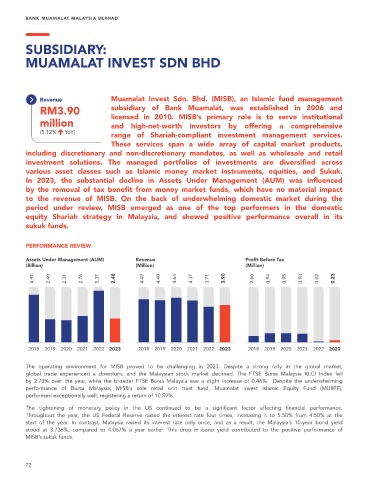

Assets Under Management (AUM) Revenue Profit Before Tax

(Billion) (Million) (Million)

4.97 2.40 2.31 2.76 5.37 2.48 4.49 4.40 4.64 4.37 3.71 3.90 0.66 0.94 0.95 0.90 0.02 0.23

2018 2019 2020 2021 2022 2023 2018 2019 2020 2021 2022 2023 2018 2019 2020 2021 2022 2023

The operating environment for MISB proved to be challenging in 2023. Despite a strong rally in the global market,

global trade experienced a downturn, and the Malaysian stock market declined. The FTSE Bursa Malaysia KLCI Index fell

by 2.73% over the year, while the broader FTSE Bursa Malaysia saw a slight increase of 0.46%. Despite the underwhelming

performance of Bursa Malaysia, MISB’s sole retail unit trust fund, Muamalat Invest Islamic Equity Fund (MUIIEF),

performed exceptionally well, registering a return of 10.59%.

The tightening of monetary policy in the US continued to be a significant factor affecting financial performance.

Throughout the year, the US Federal Reserve raised the interest rate four times, increasing it to 5.50% from 4.50% at the

start of the year. In contrast, Malaysia raised its interest rate only once, and as a result, the Malaysia’s 10-year bond yield

stood at 3.736%, compared to 4.067% a year earlier. This drop in bond yield contributed to the positive performance of

MISB’s sukuk funds.

72