Page 405 - Bank-Muamalat-Annual-Report-2021

P. 405

ANNUAL REPORT 2021 403

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

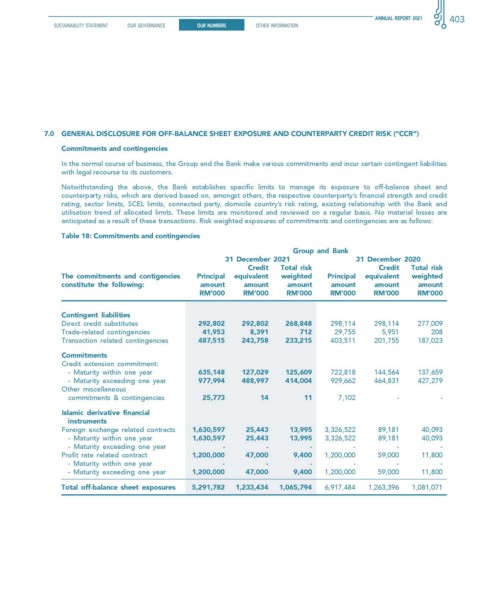

7.0 generAl DIsclosure for off-BAlAnce sheeT exPosure AnD counTerPArTy creDIT rIsK (“ccr”)

commitments and contingencies

In the normal course of business, the Group and the Bank make various commitments and incur certain contingent liabilities

with legal recourse to its customers.

Notwithstanding the above, the Bank establishes specific limits to manage its exposure to off-balance sheet and

counterparty risks, which are derived based on, amongst others, the respective counterparty’s financial strength and credit

rating, sector limits, SCEL limits, connected party, domicile country’s risk rating, existing relationship with the Bank and

utilisation trend of allocated limits. These limits are monitored and reviewed on a regular basis. No material losses are

anticipated as a result of these transactions. Risk weighted exposures of commitments and contingencies are as follows:

Table 18: commitments and contingencies

group and Bank

31 December 2021 31 December 2020

credit Total risk credit Total risk

The commitments and contigencies Principal equivalent weighted Principal equivalent weighted

constitute the following: amount amount amount amount amount amount

rM’000 rM’000 rM’000 rM’000 rM’000 rM’000

contingent liabilities

Direct credit substitutes 292,802 292,802 268,848 298,114 298,114 277,009

Trade-related contingencies 41,953 8,391 712 29,755 5,951 208

Transaction related contingencies 487,515 243,758 233,215 403,511 201,755 187,023

commitments

Credit extension commitment:

- Maturity within one year 635,148 127,029 125,609 722,818 144,564 137,659

- Maturity exceeding one year 977,994 488,997 414,004 929,662 464,831 427,279

Other miscellaneous

commitments & contingencies 25,773 14 11 7,102 - -

Islamic derivative financial

instruments

Foreign exchange related contracts 1,630,597 25,443 13,995 3,326,522 89,181 40,093

- Maturity within one year 1,630,597 25,443 13,995 3,326,522 89,181 40,093

- Maturity exceeding one year - - - - - -

Profit rate related contract 1,200,000 47,000 9,400 1,200,000 59,000 11,800

- Maturity within one year - - - - - -

- Maturity exceeding one year 1,200,000 47,000 9,400 1,200,000 59,000 11,800

Total off-balance sheet exposures 5,291,782 1,233,434 1,065,794 6,917,484 1,263,396 1,081,071