Page 400 - Bank-Muamalat-Annual-Report-2021

P. 400

398 BANK MUAMALAT MALAYSIA BERHAD

OUR LEADERSHIP

ABOUT US

ABOUT US OUR LEADERSHIP OUR STRA TEGY OUR PERFORMANCE

OUR STRATEGY

OUR PERFORMANCE

BASEL II

PILLAR 3 DISCLOSURE

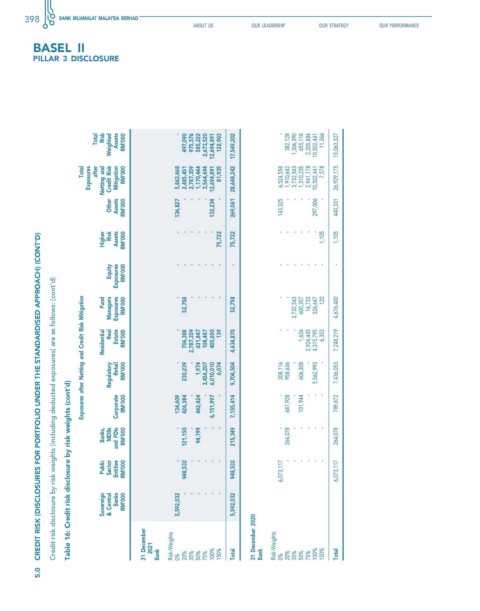

Total risk weighted Assets rM’000 - 497,090 975,576 585,222 2,673,520 122,903 - 382,128 1,306,390 655,118 2,205,884 10,502,441 11,366 15,063,327

Total exposures after and credit risk Mitigation rM’000 5,863,468 2,485,451 2,787,359 1,170,444 3,564,694 132,234 12,694,891 12,694,891 81,935 269,061 28,648,242 17,549,202 6,524,558 1,910,642 3,732,543 1,310,235 2,941,178 10,502,441 7,578 26,929,175

netting - - - - - - - - - -

other Assets rM’000 136,827 143,325 297,006 440,331

higher risk Assets rM’000 - - - - - - 75,722 75,722 - - - - - - 1,105 1,105

creDIT rIsK (DIsclosures for PorTfolIo unDer The sTAnDArDIseD APProAch) (conT’D)

equity fund Managers exposures exposures rM’000 rM’000 - - - 52,758 - - - - - - - - - - - 52,758 - - - - - 3,732,543 - 600,357 - 16,733 - 326,647 - 120 - 4,676,400

Credit risk disclosure by risk weights (including deducted exposures) are as follows: (cont’d)

exposures after netting and credit risk Mitigation residential real regulatory estate retail rM’000 rM’000 - - 706,388 230,239 2,787,359 - - 631,847 1,974 108,487 3,456,207 - 400,650 6,010,010 139 6,074 - 4,634,870 9,704,504 - 308,116 - - 958,636 - - - 1,626 606,308 2,924,445 - - 4,315,795 5,562,993 - 6,353 - - 7

Table 16: credit risk disclosure by risk weights (cont’d)

Banks, MDBs corporate fDIs rM’000 rM’000 134,609 - 426,384 121,150 - 442,424 94,199 - 6,151,997 - - 7,155,414 215,349 - 687,928 264,078 - 101,944 - - - - 789,872 264,078

and

Public sector entities rM’000 - 948,532 - - - - - 948,532 6,073,117 - - - - - - 6,073,117

sovereign & central Banks rM’000 5,592,032 - - - - - - 5,592,032

31 December Risk-Weights 31 December 2020 Risk-Weights

2021 Bank 20% 35% 50% 75% 100% 150% Total Bank 0% 20% 35% 50% 75% 100% 150% Total

0%

5.0