Page 403 - Bank-Muamalat-Annual-Report-2021

P. 403

ANNUAL REPORT 2021 401

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

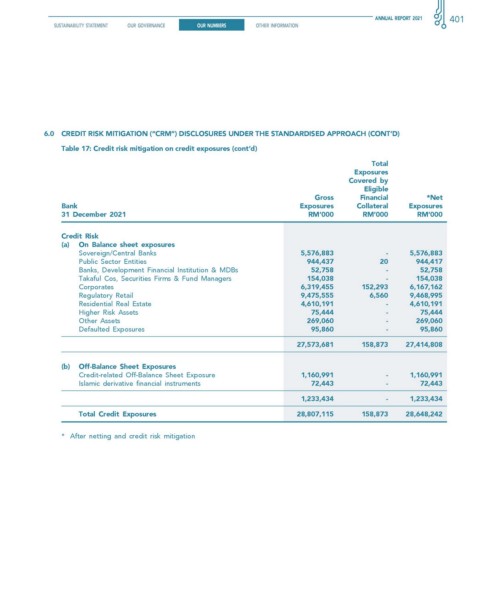

6.0 creDIT rIsK MITIgATIon (“crM”) DIsclosures unDer The sTAnDArDIseD APProAch (conT’D)

Table 17: credit risk mitigation on credit exposures (cont’d)

Total

exposures

covered by

eligible

gross financial *net

Bank exposures collateral exposures

31 December 2021 rM’000 rM’000 rM’000

credit risk

(a) on Balance sheet exposures

Sovereign/Central Banks 5,576,883 - 5,576,883

Public Sector Entities 944,437 20 944,417

Banks, Development Financial Institution & MDBs 52,758 - 52,758

Takaful Cos, Securities Firms & Fund Managers 154,038 - 154,038

Corporates 6,319,455 152,293 6,167,162

Regulatory Retail 9,475,555 6,560 9,468,995

Residential Real Estate 4,610,191 - 4,610,191

Higher Risk Assets 75,444 - 75,444

Other Assets 269,060 - 269,060

Defaulted Exposures 95,860 - 95,860

27,573,681 158,873 27,414,808

(b) off-Balance sheet exposures

Credit-related Off-Balance Sheet Exposure 1,160,991 - 1,160,991

Islamic derivative financial instruments 72,443 - 72,443

1,233,434 - 1,233,434

Total credit exposures 28,807,115 158,873 28,648,242

* After netting and credit risk mitigation