Page 401 - Bank-Muamalat-Annual-Report-2021

P. 401

ANNUAL REPORT 2021 399

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

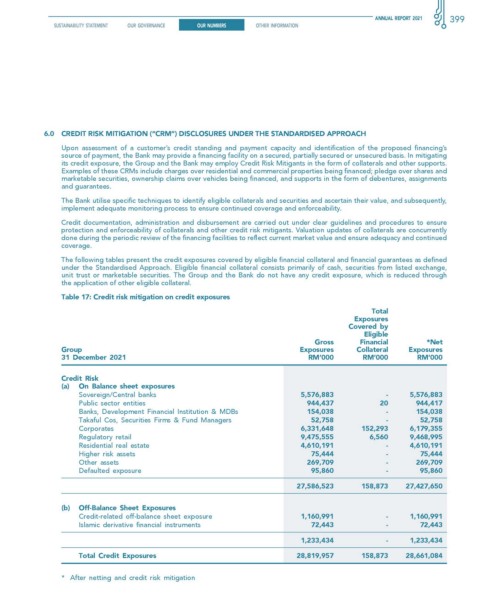

6.0 creDIT rIsK MITIgATIon (“crM”) DIsclosures unDer The sTAnDArDIseD APProAch

Upon assessment of a customer’s credit standing and payment capacity and identification of the proposed financing’s

source of payment, the Bank may provide a financing facility on a secured, partially secured or unsecured basis. In mitigating

its credit exposure, the Group and the Bank may employ Credit Risk Mitigants in the form of collaterals and other supports.

Examples of these CRMs include charges over residential and commercial properties being financed; pledge over shares and

marketable securities, ownership claims over vehicles being financed, and supports in the form of debentures, assignments

and guarantees.

The Bank utilise specific techniques to identify eligible collaterals and securities and ascertain their value, and subsequently,

implement adequate monitoring process to ensure continued coverage and enforceability.

Credit documentation, administration and disbursement are carried out under clear guidelines and procedures to ensure

protection and enforceability of collaterals and other credit risk mitigants. Valuation updates of collaterals are concurrently

done during the periodic review of the financing facilities to reflect current market value and ensure adequacy and continued

coverage.

The following tables present the credit exposures covered by eligible financial collateral and financial guarantees as defined

under the Standardised Approach. Eligible financial collateral consists primarily of cash, securities from listed exchange,

unit trust or marketable securities. The Group and the Bank do not have any credit exposure, which is reduced through

the application of other eligible collateral.

Table 17: credit risk mitigation on credit exposures

Total

exposures

covered by

eligible

gross financial *net

group exposures collateral exposures

31 December 2021 rM’000 rM’000 rM’000

credit risk

(a) on Balance sheet exposures

Sovereign/Central banks 5,576,883 - 5,576,883

Public sector entities 944,437 20 944,417

Banks, Development Financial Institution & MDBs 154,038 - 154,038

Takaful Cos, Securities Firms & Fund Managers 52,758 - 52,758

Corporates 6,331,648 152,293 6,179,355

Regulatory retail 9,475,555 6,560 9,468,995

Residential real estate 4,610,191 - 4,610,191

Higher risk assets 75,444 - 75,444

Other assets 269,709 - 269,709

Defaulted exposure 95,860 - 95,860

27,586,523 158,873 27,427,650

(b) off-Balance sheet exposures

Credit-related off-balance sheet exposure 1,160,991 - 1,160,991

Islamic derivative financial instruments 72,443 - 72,443

1,233,434 - 1,233,434

Total credit exposures 28,819,957 158,873 28,661,084

* After netting and credit risk mitigation