Page 402 - Bank-Muamalat-Annual-Report-2021

P. 402

400 BANK MUAMALAT MALAYSIA BERHAD

TEGY

OUR PERFORMANCE

ABOUT US OUR LEADERSHIP OUR STRATEGY OUR PERFORMANCE

OUR LEADERSHIP

ABOUT US

OUR STRA

BASEL II

PILLAR 3 DISCLOSURE

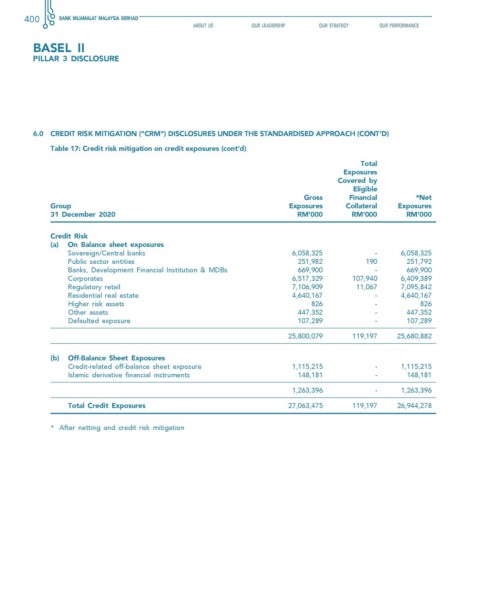

6.0 creDIT rIsK MITIgATIon (“crM”) DIsclosures unDer The sTAnDArDIseD APProAch (conT’D)

Table 17: credit risk mitigation on credit exposures (cont’d)

Total

exposures

covered by

eligible

gross financial *net

group exposures collateral exposures

31 December 2020 rM’000 rM’000 rM’000

credit risk

(a) on Balance sheet exposures

Sovereign/Central banks 6,058,325 - 6,058,325

Public sector entities 251,982 190 251,792

Banks, Development Financial Institution & MDBs 669,900 - 669,900

Corporates 6,517,329 107,940 6,409,389

Regulatory retail 7,106,909 11,067 7,095,842

Residential real estate 4,640,167 - 4,640,167

Higher risk assets 826 - 826

Other assets 447,352 - 447,352

Defaulted exposure 107,289 - 107,289

25,800,079 119,197 25,680,882

(b) off-Balance sheet exposures

Credit-related off-balance sheet exposure 1,115,215 - 1,115,215

Islamic derivative financial instruments 148,181 - 148,181

1,263,396 - 1,263,396

Total credit exposures 27,063,475 119,197 26,944,278

* After netting and credit risk mitigation