Page 410 - Bank-Muamalat-Annual-Report-2021

P. 410

408 BANK MUAMALAT MALAYSIA BERHAD

ABOUT US OUR LEADERSHIP OUR STRA TEGY OUR PERFORMANCE

ABOUT US

OUR PERFORMANCE

OUR LEADERSHIP

OUR STRATEGY

BASEL II

PILLAR 3 DISCLOSURE

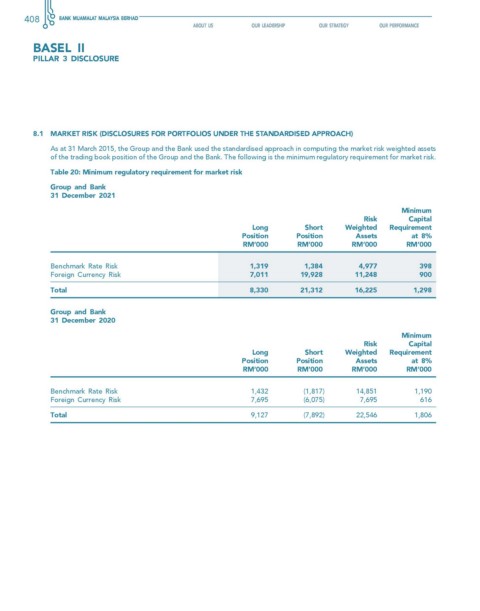

8.1 MArKeT rIsK (DIsclosures for PorTfolIos unDer The sTAnDArDIseD APProAch)

As at 31 March 2015, the Group and the Bank used the standardised approach in computing the market risk weighted assets

of the trading book position of the Group and the Bank. The following is the minimum regulatory requirement for market risk.

Table 20: Minimum regulatory requirement for market risk

group and Bank

31 December 2021

Minimum

risk capital

long short weighted requirement

Position Position Assets at 8%

rM’000 rM’000 rM’000 rM’000

Benchmark Rate Risk 1,319 1,384 4,977 398

Foreign Currency Risk 7,011 19,928 11,248 900

Total 8,330 21,312 16,225 1,298

group and Bank

31 December 2020

Minimum

risk capital

long short weighted requirement

Position Position Assets at 8%

rM’000 rM’000 rM’000 rM’000

Benchmark Rate Risk 1,432 (1,817) 14,851 1,190

Foreign Currency Risk 7,695 (6,075) 7,695 616

Total 9,127 (7,892) 22,546 1,806