Page 412 - Bank-Muamalat-Annual-Report-2021

P. 412

410 BANK MUAMALAT MALAYSIA BERHAD

OUR LEADERSHIP

ABOUT US

OUR PERFORMANCE

ABOUT US OUR LEADERSHIP OUR STRA TEGY OUR PERFORMANCE

OUR STRATEGY

BASEL II

PILLAR 3 DISCLOSURE

8.3 DIsclosure for rATe of reTurn rIsK In BAnKIng BooK (“rorBB”)

rate of return risk (“ror”) Management

Rate of return risk refers to the variability of the Bank’s assets and liabilities resulting from the volatility of the market

benchmark rates, both in the trading and banking books. The Bank actively manages the following risks:

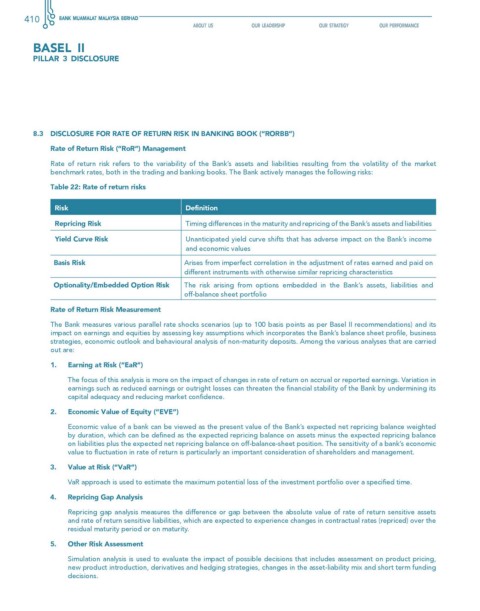

Table 22: rate of return risks

risk Definition

repricing risk Timing differences in the maturity and repricing of the Bank’s assets and liabilities

yield curve risk Unanticipated yield curve shifts that has adverse impact on the Bank’s income

and economic values

Basis risk Arises from imperfect correlation in the adjustment of rates earned and paid on

different instruments with otherwise similar repricing characteristics

optionality/embedded option risk The risk arising from options embedded in the Bank’s assets, liabilities and

off-balance sheet portfolio

rate of return risk Measurement

The Bank measures various parallel rate shocks scenarios (up to 100 basis points as per Basel II recommendations) and its

impact on earnings and equities by assessing key assumptions which incorporates the Bank’s balance sheet profile, business

strategies, economic outlook and behavioural analysis of non-maturity deposits. Among the various analyses that are carried

out are:

1. earning at risk (“ear”)

The focus of this analysis is more on the impact of changes in rate of return on accrual or reported earnings. Variation in

earnings such as reduced earnings or outright losses can threaten the financial stability of the Bank by undermining its

capital adequacy and reducing market confidence.

2. economic value of equity (“eve”)

Economic value of a bank can be viewed as the present value of the Bank’s expected net repricing balance weighted

by duration, which can be defined as the expected repricing balance on assets minus the expected repricing balance

on liabilities plus the expected net repricing balance on off-balance-sheet position. The sensitivity of a bank’s economic

value to fluctuation in rate of return is particularly an important consideration of shareholders and management.

3. value at risk (“var”)

VaR approach is used to estimate the maximum potential loss of the investment portfolio over a specified time.

4. repricing gap Analysis

Repricing gap analysis measures the difference or gap between the absolute value of rate of return sensitive assets

and rate of return sensitive liabilities, which are expected to experience changes in contractual rates (repriced) over the

residual maturity period or on maturity.

5. other risk Assessment

Simulation analysis is used to evaluate the impact of possible decisions that includes assessment on product pricing,

new product introduction, derivatives and hedging strategies, changes in the asset-liability mix and short term funding

decisions.