Page 411 - Bank-Muamalat-Annual-Report-2021

P. 411

ANNUAL REPORT 2021 409

SUSTAINABILITY STATEMENT OUR GOVERNANCE OUR NUMBERS OTHER INFORMATION

8.2 DIsclosure for equITIes

The classification of equity investments must be made at the point of transaction. Equities are classified under the banking

book when they are acquired and held for yield or capital growth purposes.

The Bank also engages in direct acquisition of newly-listed quoted shares. As stipulated under the TBPS, these investments

are considered under the trading position with the exception of investments in subsidiaries and associates which would

require BNM’s prior approval. Equities held under the trading book position are subject to market risk capital charge as

specified in the CAFIB.

The oversight and supervision of investments in equities and equity funds resides within the Investment Committee’s (“IC”)

authority. This covers decisions on purchase and sale of stocks and ongoing review and monitoring of performance.

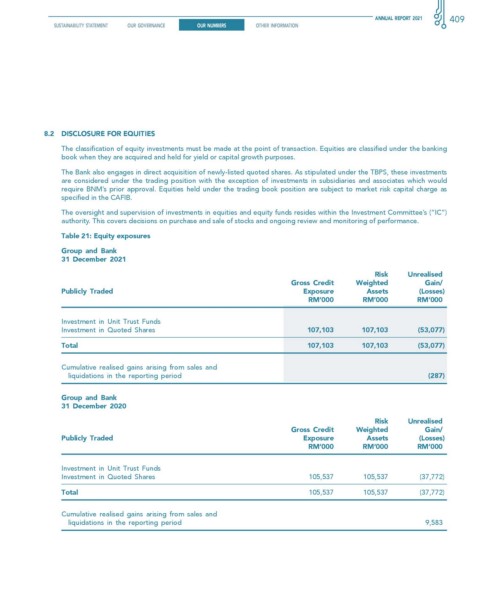

Table 21: equity exposures

group and Bank

31 December 2021

risk unrealised

gross credit weighted gain/

Publicly Traded exposure Assets (losses)

rM’000 rM’000 rM’000

Investment in Unit Trust Funds

Investment in Quoted Shares 107,103 107,103 (53,077)

Total 107,103 107,103 (53,077)

Cumulative realised gains arising from sales and

liquidations in the reporting period (287)

group and Bank

31 December 2020

risk unrealised

gross credit weighted gain/

Publicly Traded exposure Assets (losses)

rM’000 rM’000 rM’000

Investment in Unit Trust Funds

Investment in Quoted Shares 105,537 105,537 (37,772)

Total 105,537 105,537 (37,772)

Cumulative realised gains arising from sales and

liquidations in the reporting period 9,583